Johnson Matthey, down 0.1%, announced that it has appointed Numis Securities Limited as joint corporate broker alongside Citigroup Global Markets Limited with immediate effect.

Frontier Developments, down 3.6%, announced that its games label, Frontier Foundry would release the turn-based tactical RPG Warhammer 40,000®: Chaos Gate – Daemonhunters, in partnership with Warhammer 40,000 creator Games Workshop®, on 5 May 2022 and is available for pre-order now on PC across Steam and the Epic Games Store.

Oracle Power, up 1.5%, announced that the drill programme over five geochemical target areas is underway at its Jundee East Gold Project, located in the Eastern Goldfields region of Western Australia, which is located approximately 7km due east of Northern Star's 5.4Moz Jundee Gold Mine. The drill programme is expected to take between 4 to 5 weeks with results expected approximately 6 to 8 weeks from completion.

Kier Group, up 1.0%, announced that it is set to deliver a £10.4m refurbishment project at Croydon University Hospital. As a part of the contract, Kier would convert the Jubilee South Wing's ground floor into a new Intensive Treatment Unit (ITU) and relocate the hospital's dedicated Stroke Unit to the Jubilee North Wing.

Aferian, unchanged at 146.5p, in its final results for the year ended 30 November 2021, announced that revenues rose to $92.89m from $82.70m recorded in the previous year. Profit before tax widened to $5.26m from $4.41m. The Board of Directors have proposed a final dividend of 2.09p per share, resulting in a total dividend for the year of 3.09p per share.

Feedback, unchanged at 0.7p, in its unaudited results for the six months to 30 November 2021, announced that revenues climbed to £0.18m from £0.17m recorded in the same period previous year. Loss after tax widened to £1.06m from £0.72m. Further, the company’s full year outlook is expected to be ahead of market expectations.

Science Group, unchanged at 410.0p, confirmed Mr Jon Brett's appointment as Group Finance Director, with effect from 1 March 2022.

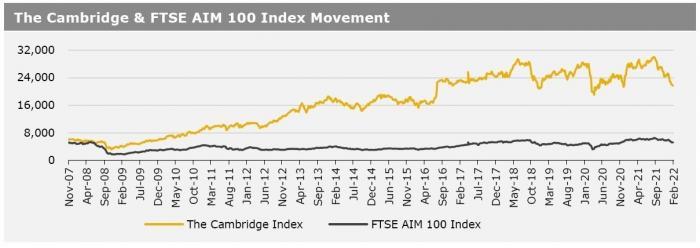

UK markets ended mostly higher last week, after British Prime Minister, Boris Johnson hinted at ending all Covid restrictions. On the data front, UK’s gross domestic product (GDP) expanded at its fastest pace in 80 years in 2021, rebounding from its historic plunge in 2020. However, the country’s fourth quarter GDP grew less than expected. Additionally, UK house prices reached a record high in January, while the BRC retail sales rose in January, driven by rise in consumer spending. The FTSE 100 index advanced 1.9% to settle at 7661.0, while the FTSE techMARK 100 index gained 0.7% to end at 6407.5. Meanwhile, the FTSE AIM 100 index fell 0.2% to close at 5205.1.

US markets ended lower in the previous week, amid fears that the US central bank will hike rates aggressively. On the macro front, the US consumer prices accelerated to a 40-year high in January, driven by rise in food prices, energy costs and shelter costs, while the nation’s weekly jobless claims dropped for a third consecutive week in the week ended 4 February 2022. Additionally, US reported a budget surplus for the first time since September 2019 in January. On the other hand, the nation’s trade deficit reached a record high in 2021, amid continued dependence on imports from China and other countries, while the consumer sentiment index dropped to a 10-year low in February. The DJIA index fell 1.0% to end at 34738.1, while the NASDAQ index lost 2.2% to close at 13791.2.