Abcam, up 1.1%, in its trading update, announced that it expects total revenues for the 12 months ended 31 December 2021 of approximately £315m. Overall, it anticipates its adjusted operating profits to be in line with the board's expectations and remains on track to achieve its financial goals for the five-year plan ending in 2024. The company would release its financial results for the period ended 31 December 2021 on 14 March 2022.

LPA Group, up 8.9%, in its final results for the year ended 30 September 2021, announced that its revenues dropped to £18.27m from £20.71m recorded in the previous year. Loss after tax stood at £0.03m compared to a profit of £0.60m. No interim or final dividends have been declared in 2021.

Cambridge Cognition Holdings, up 7.2%, in its trading update for the year ended 31 December 2021, announced that it made significant progress in 2021, with strong growth in orders and revenues and earnings ahead of market expectations. Also, order intake for the year was up by 25%, driven by commercial execution, a broader product offering and demand for virtual clinical trials. The company expects to release its preliminary results in March 2022.

Gaming Realms (former PDX Plc), down 10.5%, in its pre-close trading update for the full year to 31 December 2021, announced that it expects FY21 revenue and adjusted EBITDA to increase by 27% and 70%, respectively, on yearly basis. This strong performance was driven by the continued growth of the Group's licensing business that, during FY21, launched in two new US regulated iGaming markets of Michigan and Pennsylvania, and with 35 new partners internationally. Moreover, it expects to report its FY21 preliminary results during the week commencing 25 April 2022.

Aferian (former Amino Technologies) down 6.3%, announced that it would release its results for the year ended 30 November 2021 on 10 February 2022. Feedback, down 6.3%, today, announced that it would publish its interim results for the six months ended 30 November 2021 on 10 February 2022.

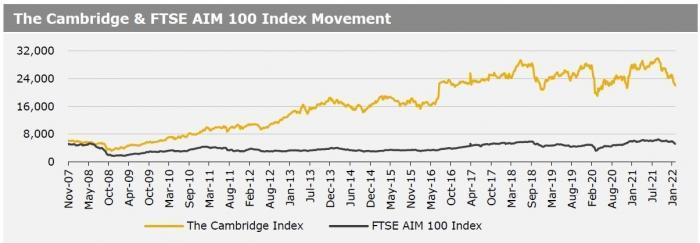

UK markets ended lower last week, amid geopolitical tensions and concerns over higher interest rates. On the data front, UK’s manufacturing PMI unexpectedly dropped in January, while the nation’s services PMI unexpectedly declined to an 11-month low level in the same month, due to the spread of new Omicron variant of Covid-19. Meanwhile, Britain’s government borrowed less than expected in December. Adding to the negative sentiment, the International Monetary Fund lowered its UK’s growth forecast for this year citing disruption from the Omicron variant of the coronavirus, labour shortages and high energy prices, but raised its growth estimate for 2023. The FTSE 100 index declined 0.4% to settle at 7,466.1, while the FTSE AIM 100 index fell 4.7% to close at 5,208.2. Meanwhile, the FTSE techMARK 100 index lost 3.3% to end at 6,379.8.

US markets ended higher in the previous week, as US economic growth accelerated in the fourth quarter of 2021. On the macro front, the US GDP expanded more than expected in 4Q 2021, amid surge in business inventories and consumer spending., while new home sales accelerated at its highest level in 10 months in December, as buyers took advantage of lower prices. Additionally, the nation’s weekly jobless claims declined for the first time in four weeks in the week ended 21 January 2022. On the flipside, the US consumer confidence index fell for the first time in four months in January, amid concerns over economic outlook. Moreover, the US durable goods orders declined in December, driven by sharp decline in aircraft demand, while pending home sales fell for a second straight month in December. In a key development, the US Federal Reserve indicated an interest rate hike as soon as March and warned that inflation will stay high for a prolonged period. The DJIA index gained 1.3% to end at 34,725.5, while the NASDAQ index slightly rose to close at 13,770.6.