Johnson Matthey, down 6.1%, announced the completion of the sale of its Advanced Glass Technologies business to Fenzi Holdings SPV S.p.A for £178m.

Abcam, down 0.4%, announced that it has collaborated with Twist Bioscience Corporation to enhance antibody discovery, development and commercialization for diagnostic and research applications, with Twist retaining rights for therapeutic applications.

Cambridge Cognition, up 13.1%, announced that it has won contracts worth £2.1m to provide cognitive assessments, electronic diaries, and third-party hardware for two clinical trials in neurodegenerative disease.

Checkit, up 8.0%, announced that it has entered into a three-year contract worth £2.8m with Biomat USA, Inc., a subsidiary of Grifols S.A. (Grifols). Of the total contract value, approximately 12% represents the renewal of existing business with Grifols with the remainder representing upsell and new business.

Tristel, up 2.4%, announced that it would release its interim results for the six months ended 31 December 2021 on 21 February 2022.

Quixant, up 0.3%, announced that it has been recognised as one of London's top green businesses and has won the London Stock Exchange's Green Economy Mark award.

Kier Group, down 6.4%, announced that it has been selected by North Somerset Council and Cabot Learning Federation to deliver a new £30.5m net zero carbon building for Winterstoke Hundred Academy in Weston-Super-Mare.

Science Group, down 3.5%, today confirmed Mr Jon Brett's appointment as Group Finance Director, with effect from 1 March 2022. Feedback, down 3.3%, announced that it would publish its results for the half year ended 30 November 2021 on 10 February 2022.

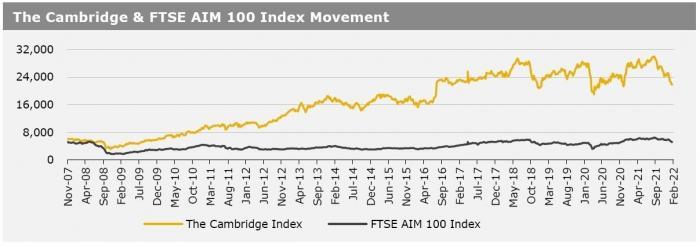

UK markets ended mostly firmer last week, on the back of higher oil prices. On the data front, UK’s services PMI rose in January, as restrictions related to the pandemic were eased and customer demand rebounded, while the nation’s house prices accelerated at its fastest annual pace in 17 years in January, driven by robust demand and low supply. Meanwhile, Britain’s manufacturing PMI dropped to a 4-month low in January, reflecting slower growth in new orders. Separately, the Bank of England (BoE) raised its key interest rate to 0.50% to curb rising inflation, thus marking its second consecutive rate hike since 2004. The FTSE 100 index advanced 0.7% to settle at 7,516.4, while the FTSE AIM 100 index rose 0.1% to close at 5,213.6. Meanwhile, the FTSE techMARK 100 index lost 0.3% to end at 6,360.5.

US markets ended higher in the previous week, following positive US jobs data. On the macro front, the US weekly jobless claims fell in the week ended 28 January 2022, while the JOLTs job openings climbed in December. Additionally, the US nonfarm payroll rose more than expected in January. On the other hand, the US ISM manufacturing PMI dropped to a 14-month low in January, due to a surge in Covid-19 cases linked to the Omicron variant, while the nation’s service sector activity weakened declined in January, reflecting a slowdown in the pace of growth in business activity. Additionally, the US private sector employment sharply fell in January, as surging Omicron cases disrupted business operations, while the unemployment rate climbed in January. Moreover, the nation’s factory orders dropped more than expected in December, amid supply constraints. The DJIA index rose 1.0% to end at 35,089.7, while the NASDAQ index gained 2.4% to close at 14,098.0.