Abcam, up 2.6%, announced a strategic development and supply partnership with Nautilus Biotechnology Inc, a company pioneering a single-molecule protein analysis platform for quantifying the proteome.

CyanConnode, up 28.8% today, in its interim results announced that revenues rose to £4.08m from £1.50m recorded in the same period last year. Cash and cash equivalents at end of period stood at £1.7m.

SDI Group, up 13.8%, in its trading update, announced that it expects to deliver robust sales and profits for the six months ended 31 October 2021. The group expects to release its interim results for the six months to 31 October 2021 on 7 December 2021.

GRC International Group, up 7.4%, in its H1 FY22 trading update, announced that robust momentum witnessed through H2 FY21 would continue across all areas of the business in H1 FY22, with billings up 26% on the comparative period.

Bango, up 1%, announced that it is powering the first telecommunications company (telco) to offer bundled Microsoft 365 subscriptions, launching with a major global telecoms provider in the UK.

Oracle Power, down 16.1%, announced that an updated presentation on Western Australian gold assets has been uploaded to its website at: http://www.oraclepower.co.uk/investor-relations/presentations/.

Feedback, down 5.9%, in its audited results for the 12 months to 31 May 2021, announced that revenues declined to £0.29m from £0.45m recorded in the prior year.

Gaming Realms, down 4.1%, in its trading update announced that it has now been granted a full iGaming Supplier License in Michigan after operating with a provisional permit since January 2021.

Xaar, down 2.8%, announced that it has completed the proposed divestment of its remaining interest in Xaar 3D.

Cambridge Cognition, down 0.7%, announced that Chief Financial Officer, Michael Holton has resigned from the board.

UK markets ended higher last week, as the Bank of England (BoE) kept its interest rates at record lows and maintained its asset-purchase programme. On the data front, UK’s manufacturing index rose for the first time in five months October, while the nation’s services activity registered a sharp growth in October. Additionally, UK’s Nationwide house prices grew at a faster-than-expected in October, amid robust demand while the Halifax house prices grew at its fastest pace in four months in October, signalling strong momentum in the housing market.

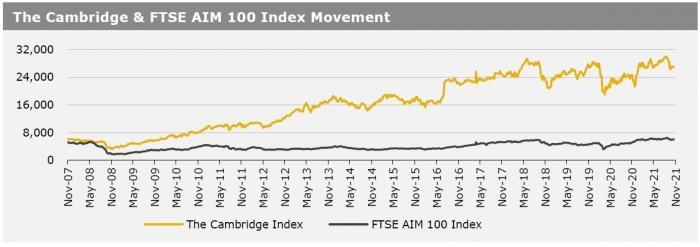

The BoE left its benchmark interest rate unchanged at 0.10%, defying market expectations. However, the central bank hinted at future interest rate hike in order to tame rising inflation. The FTSE 100 index advanced 0.9% to settle at 7304.0, while the FTSE AIM 100 index rose 1.6% to close at 6084.1. Also, the FTSE techMARK 100 index gained 1.5% to end at 7140.4.

US markets ended higher in the previous week, following upbeat jobs report and Federal Reserve’s (Fed) taper plans. On the macro front, the US ISM services PMI rose to a record high in October, while the nation’s factory orders unexpectedly climbed in September. Additionally, US private sector employment increased more than expected in October, while the nation’s unemployment rate fell in October. Also, the US weekly jobless claims dropped to a 20-month low in the week ended 29 October 2021, while the nation’s non-farm payrolls climbed more than expected in October, reflecting progress in the labour market.

The US Fed kept its benchmark rate unchanged at 0.25% and announced that it would begin to taper its $120b monthly bond-buying program. Also, the Fed indicated that it would remain patient on raising interest rates as data showed the economy’s recovery from the pandemic was intact. The DJIA index rose 1.4% to end at 36328.0, while the NASDAQ index gained 3.1% to close at 15971.6.