AVEVA Group, up 7.8%, stated that revenue grew around 1.5%.

Johnson Matthey, up 2.3%, announced that it has appointed Stephen Oxley as Chief Financial Officer. Separately, the firm announced a deal with SFC Energy AG.

Abcam, up 16.2%, announced that it anticipates total revenue of around £147.5m for the first half. Frontier Developments, up 1.7%, announced that trading in the first half was in line with the board’s expectations.

Science Group, up 10.3%, announced that it expects revenue for 2020 to be around £73.0m.

LPA Group, up 4.7%, announced that it has provided two contract awards for the UK rail market.

1Spatial, up 1.8%, announced that it has entered into an agreement with the State of California's Office of Emergency Services in the USA, for its 1Integrate and 1Data Gateway SaaS offering.

Bango, up 0.6%, announced that the group reported revenue ahead of forecasts at £12.2m, representing a YoY growth of 70%.

Quixant, remained unchanged at 138.5p, announced that it has appointed Francis Small as Senior Independent Non-Executive Director.

Xaar, down 22.4%, announced that its trading performance was in line with board’s expectations, with the on-going successful implementation of the new strategy.

CyanConnode, down 7.7%, announced that revenues stood at £3.4m for the nine-months ended December 2020. IQGeo Group, down 5.1%, announced today that it anticipates reporting good progress in all key metrics. Revenue for the year is expected to be not less than £9.0m.

Oracle Power, down 4.3%, announced that the final quarter of the year was a significant period for the company, presenting considerable opportunities despite frustrations relating to certain delays in Pakistan.

Quartix, down 2.2%, announced that it anticipates revenue, profit and free cash flow to be in line with current market forecasts. Further, the board intends to declare a final dividend in line with its stated policies.

GRC International Group, down 1.9%, announced that it has launched a new website for its subsidiary, DQM GRC, focused on Privacy by Design capability and market leading position in services.

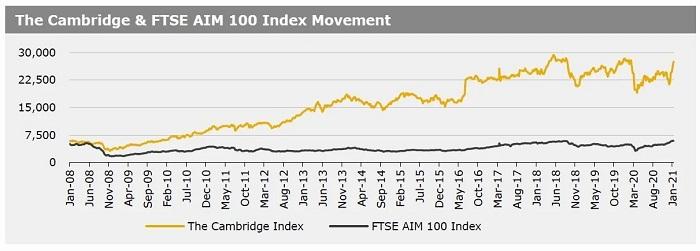

UK markets ended lower last week, amid persistent concerns over surging coronavirus cases and stringent lockdown measures introduced by the UK government. On the data front, the UK retail sales dropped to a 25-year low in 2020, driven by prolonged store closures, while RICS house price balance climbed more than expected in December. Meanwhile, the UK economy contracted less-than-expected in November, despite a second nationwide lockdown. Separately, Bank of England Governor, Andrew Bailey dismissed the possibility of negative interest rates and warned that resurgence in coronavirus cases might send the UK economy back into recession. The FTSE 100 index declined 2% to settle at 6735.7, while the FTSE AIM 100 index fell 1.3% to close at 5910.4. Also, the FTSE techMARK 100 index lost 1.3% to end at 6356.6.

US markets ended lower in the previous week, amid concerns that Joe Biden’s stimulus plan would lead to higher interest rates, corporate taxes and following dismal US jobs data. On the macro front, US consumer prices rose in December, while the nation’s weekly jobless claims climbed to its highest level in four months in the week ended 08 January. Meanwhile, the nation’s retail sales dropped for the third month in a row in December, while the US consumer sentiment dropped more-than-expected in January. In major news, US President-elect Joe Biden unveiled a $1.9t stimulus package. Separately, Federal Reserve, Chairman Jerome Powell stated that the central bank would continue with its bond buying programme. The DJIA index fell 0.9% to end at 30814.3, while the NASDAQ index lost 1.5% to close at 12998.5.