Barclays Capital retained its “Equal Weight” rating on Johnson Matthey, up 1.1%, with a target price of 2450p. UBS maintained its “Sell” rating on the stock with a target price of 1900p.

Davy Research reiterated its “Neutral” rating on DS Smith, down 7%, with a target price of 300p.

Abcam, down 1%, announced that it has entered into a partnership with Cancer Research UK for the development and commercialisation of novel custom antibodies to support the acceleration of cancer research. JP Morgan Cazenove reiterated its “Neutral” rating on the stock with a target price of 1400p.

SDI Group, up 3.1%, announced that it will release its final results for the year ended 30 April 2020 on 21 July 2020.

Checkit, unchanged at 40.5p, announced the appointment of Aylsa Muir as Chief Financial Officer (CFO) designate and she is expected to join the Board in September 2020. Separately, the firm introduced new EMI options scheme and has granted options over ordinary shares at 5p each to all staff on 7 July 2020.

LPA Group, unchanged at 64p, announced that it has won further contracts for both UK and export rail markets. Output against the contract is estimated to commence in FY20 and majority of output is expected through FY21.

Horizon Discovery Group, down 1%, announced that it will release an unaudited pre-close trading update on 29 July 2020. Separately, the company unveiled Cas9 and dCas9-VPR stable cell lines which can be used to accelerate gene editing workflows.

Oracle Power, down 11.1%, announced that it has entered into a financing facility, with share subscriptions deed of 0.1p. The total financing facility is up to £46,500,000. The placing subscription facility will be available to the company for 60 months from the execution of the financing facility, to support future project expenditures.

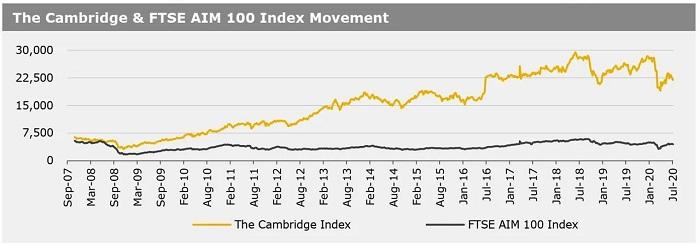

UK markets closed lower last week, as a continued spike in global coronavirus cases undercut risk appetite and following a gloomy economic forecast from rating agency Moody's. The agency forecasted a sharper peak-to-trough contraction for the UK in 2020, than for any other G20 economy. On the data front, UK’s construction sector gathered pace in June, as lockdown restrictions eased and output surged. In contrast, the nation’s house price index fell for the fourth straight month in June, the longest run of monthly declines since 2010. Separately, British Finance Minister, Rishi Sunak, unveiled an additional £30 billion plan to boost the UK economy. The FTSE 100 index declined 1% to settle at 6095.4, while the FTSE AIM 100 index dropped 2.4% to close at 4476.3. Meanwhile, the FTSE techMARK 100 index also lost 1.9% to end at 5240.8.

US markets ended higher in the previous week, amid optimism over a potential coronavirus treatment. In economic news, the US non-manufacturing PMI rebounded in June, marking its single-biggest increase since the survey began in 1997. The US weekly jobless claims dropped to a near four-month low last week and JOLTS jobs openings advanced in May. Meanwhile, US consumer credit dropped in May, indicating that US households have been less willing to borrow to make purchases than in the past. US producer prices dipped in June, reflecting depressed demand in retail and other major parts of the economy due to the coronavirus pandemic. The DJIA index rose 1% to end at 26075.3, while the NASDAQ index gained 4% to close at 10617.4.