AVEVA Group, down 3.5%, announced that its annual revenues rose to £833.8m from £766.6m, while profit before tax nearly doubled to £92m from £46.7m in the last year. The board intends to pay a final dividend of 29p per share. Credit Suisse lifted its target price on the stock to 4500p from 4200p and gave an “Outperform” rating.

DS Smith, down 7.4%, announced that it has appointed Wouter van Tol as Head of Sustainability and Government Affairs.

Johnson Matthey, down 7.1%, announced that its annual revenues climbed to £14.6b from £10.7b recorded in the previous year. Its profit before tax declined to £305m from £488m, while basic earnings per share dropped to 132.3p from 215.2p. The board has proposed a final dividend of 31.1p per share. Deutsche Bank downgraded its rating on the stock to “Hold” from “Buy” and lowered its target price to 2200p from 2700p. Credit Suisse trimmed its target price on the stock to 3100p from 3200p and reaffirmed its “Outperform” rating.

Frontier Developments, down 5.3%, in its trading update, announced that the board expects to report revenues of around £76m, with an operating profit of nearly £16m for the period. Frontier stated that it has entered new financial year confidently with the unveiling of Elite Dangerous: Odyssey, a major new paid-for update for Elite Dangerous game. Credit Suisse raised its target price on the stock to 2200p from 2150p and reaffirmed its “Outperform” rating.

1Spatial, up 26.2%, announced that its annual revenues jumped to £23.4m from £17.6m recorded in the previous year. Its loss before tax narrowed to £1.7m from £1.8m. 1Spatial stated that trading in the new financial year has begun in line with management’s expectations. Separately, the company signed a multi-year agreement with the State of Michigan in the USA, with an initial contract value of around $2.6m. The contract consists of services worth $1.5m to be delivered in the first two years, whilst software licences worth $1.1m will be recognised over the five years.

Feedback, unchanged at 1.1p, announced today that it has raised $5.05m via placing of 505m new ordinary shares.

Gaming Realms, down 2.4%, announced that the resolutions from 1 to 6 were passed duly in the Annual General Meeting (AGM), dated 18 May 2020. However, the resolution 7, which include disapplication of pre-emption rights, could not achieve 75% majority in the AGM.

Amino Technologies, down 3.1%, in its half-yearly trading update, announced that it expects revenue to rise to $38.1m from $34.6m in H12019, despite challenges in supply chain and delayed orders. Revenue from software and services jumped to $9.8m from $3.6m.

Bango, down 7.3%, announced today that it has introduced carrier billing payment option for SoftBank Corporation on Amazon.co.jp.

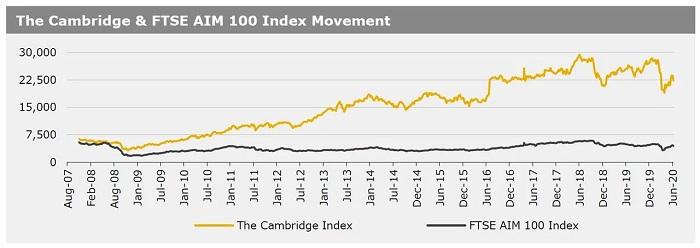

UK markets closed lower last week, after the Organisation for Economic Cooperation and Development forecasted that the UK economy will contract sharply this year. On the data front, the UK economy posted its biggest monthly contraction on record in April, while the industrial production dropped more than expected in the same month. On the contrary, British like-for-like retail sales climbed in May, while trade deficit narrowed in April. The FTSE 100 index plummeted 5.8% to settle at 6105.2, while the FTSE AIM 100 index declined 5% to close at 4431.6. Moreover, the FTSE techMARK 100 index dropped 4.9% to end at 5230.9.

US markets ended lower in the previous week, after the US Federal Reserve warned that the US economy will contract 6.5% in 2020 due to the coronavirus pandemic. On the macro front, the US consumer prices fell unexpectedly in May, while initial jobless claims dropped more than expected in the last week. Moreover, JOLTS job openings dropped to its lowest level since 2014 in April, while the budget deficit narrowed more than expected in May. The DJIA index fell 5.6% to end at 25605.5, while the NASDAQ index also lost 2.3% to close at 9588.8.