AVEVA Group, up 1.7%, announced that it has agreed to enter into a strategic partnership with DORIS Group and Schneider Electric to deliver Digital Twin technology for the upstream oil and gas markets.

Bernstein reiterated its “Outperform” rating on Johnson Matthey, up 9.1%, with a target price of 3500p.

Berenberg reiterated its “Hold” rating on DS Smith, up 4%, with a target price of 290p.

Xaar, up 22.1%, in its trading update for the six months ended 30 June 2020, announced that its performance was in line with expectations.

IQGeo, up 10.1%, in its trading update for the first half ended 30 June 2020, announced that it expects revenue growth of more than 100% at £5.4m, compared to the same period in the previous year.

Gaming Realms, up 1.8%, announced that it has signed a licensing agreement with Inspired Entertainment to develop a new game under the Reel King brand.

Quartix, unchanged at 305p, announced that it will release its unaudited interim results for the half-year to 30 June 2020, on 28 July 2020.

Marshall Motor, unchanged at 122.5p, announced that all resolutions were duly passed at its Annual General Meeting (AGM) held on 16 July 2020.

1Spatial remained unchanged at 22.5p. The firm announced that it has become a member of techUK, the UK’s leading technology membership organisation.

Cambridge Cognition, down 6.2%, announced a collaboration with 4YouandMe and The Center for International Emergency Medical Services (CIEMS).

Feedback, down 7.1%, announced that it has appointed Philipp Prince as a new Independent Non-Executive Director, with immediate effect.

Bango, down 12.5%, in its trading update for the six months ended 30 June 2020, announced that it has recorded an increase in revenue growth of over 50% to £4.8m, compared to the same period in the previous year.

Oracle Power, down 15.6%, announced that it has received pro rata contribution from China National Coal Development Co Ltd (CNCDC), as part of the application process for a Letter of Intent.

Quixant, down 4.3%, announced that its subsidiary, Densitron Technologies, has entered into new long-term collaboration with Hertfordshire-based consultancy, Hawk Media Partnership.

Netcall, down 1.4%, in its trading update for the year ended 30 June 2020, announced that it expects full year revenue to rise by 10% to £25.1m.

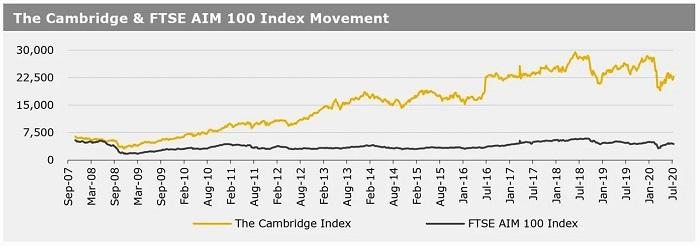

UK markets closed mostly higher last week, amid growing hopes for a coronavirus vaccine and after the Bank of England Governor, Andrew Bailey, stated that British economy was starting to recover from its coronavirus lockdown. On the data front, the UK economy rebounded on a monthly basis in May. Moreover, UK’s inflation rose for the first time this year in June, buoyed by an increase in the prices of computer games and consoles. The FTSE 100 index advanced 3.2% to settle at 6290.3, while the FTSE AIM 100 index fell 0.9% to close at 4435.1. Meanwhile, the FTSE techMARK 100 index gained 4.4% to end at 5472.

US markets ended mixed in the previous week, as investors weighed the prospect of additional fiscal stimulus against fears of further business disruptions due to a record rise in COVID-19 cases. In economic news, US consumer prices and retail sales advanced in June. Meanwhile, the Federal Reserve, in its Beige Book report, stated that economic activity increased in nearly all of its districts in recent weeks. The DJIA index rose 2.3% to end at 26672, while the NASDAQ index lost 1.1% to close at 10503.2.