AVEVA Group, up 8.7%, announced that it is in advanced talks with OSIsoft, LLC (OSIsoft) regarding a potential acquisition.

Johnson Matthey, up 4.4%, announced that it has been selected by China’s Ningxia Baofeng Energy Group as licensor for the third methanol synthesis plant at their coal to olefins complex near Yinchuan in Ningxia Province PRC.

Gaming Realms, up 21%, announced that it has signed a three-year licensing and distribution agreement with Oryx Gaming. Separately, the company announced that it will release its interim results on 8 September 2020.

Horizon Discovery Group, up 9.6%, announced that it has introduced single cell RNAseq-linked pooled CRISPR screening to its CRISPR screening services portfolio.

LPA Group, up 8.9%, announced that it has won two more contracts for UK and export rail markets worth £1.5m collectively.

Both contracts are due to commence supply in early FY21. Bango, up 4.2%, announced that it has entered into a partnership with Nonvoice, the leading 5G app agency.

IQGeo Group, up 2.6%, announced that it has appointed Haywood Chapman as Chief Financial Officer to the Board, with effect from 10 September 2020.

Quixant, up 0.9%, announced today the resignations of the Chief Financial Officer, Guy Millward and the Independent Non-Executive Director, Nigel Payne, from the board.

Amino Technologies, down 2.1%, announced today that it will publish and post explanatory circular to the shareholders, convening a general meeting to be held on 4 September 2020.

Xaar, down 2.2%, announced the appointment of Investec Bank Plc as corporate broker with immediate effect.

Dialight, down 9.4%, in its half year results for the period ended 30 June 2020, announced that revenues declined to £56.3m from £76.1m. Loss before tax widened to £6.0m from £3.8m. The firm witnessed a significant reduction in overall order intake during April and May due to weakness in its main industrial sectors when the COVID-19 crisis was at its peak.

Checkit remained unchanged at 38.5p, announced that Non-Executive Director, Ric Piper, has resigned from the Board with immediate effect. Further, Non-Executive Director, John Wilson, will assume the position of Chair of the Audit Committee and is set to join the Remuneration Committee.

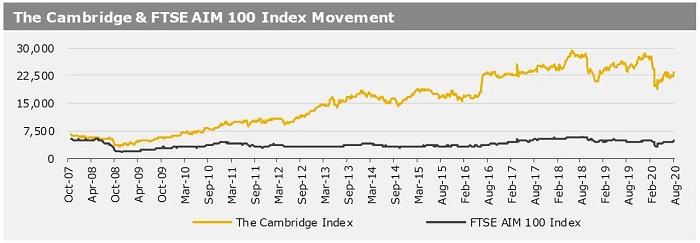

UK markets closed higher last week, amid hopes of economic recovery. On the data front, UK’s manufacturing PMI grew at its fastest pace in nearly three years, while the services PMI entered expansionary territory in July. Additionally, the nation’s construction PMI expanded in July at its steepest pace since October 2015. In major news, the Bank of England kept the key interest rate unchanged at 0.1% and warned of a slower-than-expected rebound from the COVID-19 pandemic. The central bank also maintained its asset purchase programme at £745 billion. The FTSE 100 index added 2.3% to settle at 6032.2, while the FTSE AIM 100 index gained 6.6% to close at 4756.9. Additionally, the FTSE techMARK 100 index rose 4.9% to end at 5729.2.

US markets ended firmer in the previous week, amid speculation of another stimulus plan by the US government. On the macro front, the US ISM manufacturing PMI climbed to its highest level since 2019 in July, despite a resurgence in new COVID-19 cases, while the ISM services PMI unexpectedly rose for the second consecutive month in July. Additionally, the factory orders came in higher-than-expected in June. In contrast, the US nonfarm increased more than expected in July and unemployment rate fell during the same period. The DJIA index rose 3.8% to end at 27433.5, while the NASDAQ index gained 2.5% to close at 11011.