AVEVA Group, up 19.1%, announced that it has entered into an agreement for the acquisition of OSIsoft, at an enterprise value of $5.0 billion.

Frontier Developments, up 9.1%, in its trading update, announced that the firm would bring the full Jurassic World Evolution experience to Nintendo Switch on November 3, 2020. After a strong close to FY 2020, sales across all of the games in FY 2021 to date have been consistent with expectations and the firm is on track to deliver revenue within the top half of the current range of analyst projections of £83m to £95m for FY 2021. Shore Capital lifted its target price on the stock to 2000p from 1900p and reaffirmed its “Hold” rating.

Oracle Power, up 7.4%, announced that alongside its consortium partners, China National Coal Development Company Ltd and the private office of His Highness Sheikh Ahmed Bin Dalmook Juma Al Maktoum, it has been invited to meet with the Private Power and Infrastructure Board (PPIB) in Pakistan early this month to present the implementation plan for the Thar Block VI project, with a view to finalising a letter of intent (LOI).

SDI Group, up 6.2%, announced that its AGM will be held on 23 September 2020.

Gaming Realms, up 2.6%, announced that it has won its first multi-state direct-integration agreement with its existing partner, Rush Street Interactive (RSI). Also, the company's existing partnership agreement with RSI is being extended to incorporate the additional US State of Pennsylvania, RSI's largest territory.

Cambridge Cognition, down 2.5%, announced that it has secured a £2m contract as the cognitive assessment partner for three late phase clinical trials for a pharmaceutical company's lead drug candidate for patients with schizophrenia.

Xaar, down 3.3%, announced that it has launched a highly advanced and simple to install printhead, following close collaboration with its global OEMs.

Amino Technologies remained unchanged at 129p. The firm announced that it wishes to provide an update with regards to Resolution 1 to be proposed at the company's general meeting, to be held on 4th September 2020.

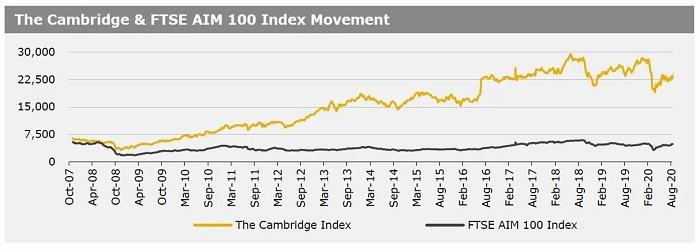

UK markets closed mostly higher last week, boosted by positive headlines around US-China trade and amid fresh hopes of a coronavirus treatment. On the data front, the UK’s Confederation of British Industry (CBI) distributive trades survey unexpectedly dropped on a monthly basis in August. Moreover, the CBI reported that retail employment fell in August at its fastest pace since the financial crisis, with a worse score expected for September, as the government withdraws support for jobs. The FTSE 100 index slid 0.6% to settle at 5963.6, while the FTSE AIM 100 index rose 0.8% to close at 4894.8. Additionally, the FTSE techMARK 100 index gained 2.5% to end at 5769.4.

US markets ended higher in the previous week, as investors digested the US Federal Reserve’s new strategy to adopt an average inflation target and restore the nation to full employment. It underlined the central bank’s willingness to keep interest rates at record low levels for an extended period. Further, US and Chinese officials reaffirmed their commitment to a trade deal signed in January. Hopes for a potential COVID-19 treatment also bolstered trading. On the data front, a revised reading of 2Q 2020 US gross domestic product showed that the economy contracted at an annualised pace. House prices rose more than expected on a monthly basis in June. Moreover, durable goods orders hit their highest level since February last month, marking the third consecutive monthly rise, driven by a surge in automobile demand. The DJIA index rose 2.6% to end at 28653.9, while the NASDAQ index gained 3.4% to close at 11695.6.