Johnson Matthey, down 2.1%, announced that it is expanding its fuel cell operations into China, with a £7.5m facility and that the new site will be fully operational by January 2021.

Abcam, up 9.6%, announced a registered public offering of 8,945,218 American depositary shares (ADSs).

Frontier Developments, down 4.4%, announced that at its Annual General Meeting (AGM) held on 21 October 2020, all resolutions put to shareholders were duly passed.

LPA Group, up 17.1%, announced that it won a significant project award for the export rail market.

SDI Group, up 12.9%, in its trading statement for the current financial year ending 30 April 2021, announced that two of its businesses, Atik Cameras and MPB Industries, secured significant contracts to supply cameras and flowmeters, respectively, for PCR DNA amplifiers and for respirators.

Quartix Holdings, up 6.6%, in its trading update for the nine months ended 30 September 2020, announced that despite the serious impact of COVID-19, the firm has achieved in the year to date approximately 7% revenue growth in its core fleet business, compared to the same period in the previous year.

Feedback, up 5%, announced that it has teamed up with Axial3D (Axial Medical Printing Limited) to enable the visualisation and use of 3D clinical-grade medical images from a patient's own 2D scan through Feedback's flagship medical imaging communications platform, Bleepa.

Checkit, up 2.3%, announced that certain subsidiaries have entered into a framework agreement with John Lewis Plc for the supply of connected workflow, asset monitoring and building management solutions for a period of three years.

Gaming Realms, down 2.6%, announced that it has introduced its Slingo Originals content with betting and gaming operator, Paddy Power Betfair.

IQGeo Group remained unchanged at 69p. The firm announced the extension of a significant contract for software licences and services with a large utility network operator that provides energy and construction services across the USA.

GRC International Group remained steady at 24.5p. The company announced that at its AGM held on 20 October 2020, all resolutions were duly passed.

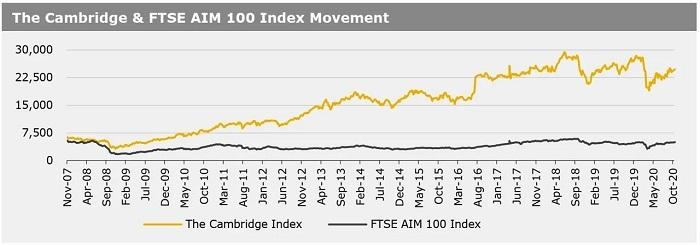

UK markets ended mostly lower last week, amid concerns over fresh coronavirus restrictions. Meanwhile, British Finance Minister, Rishi Sunak, unveiled more support for businesses hit by the coronavirus pandemic. On the data front, UK’s composite PMI fell to a four-month low in October. In contrast, UK consumer price inflation rose in September. British retail sales continued to improve in September for the fifth consecutive month. Separately, the Bank of England's Chief Economist, Andy Haldane, stated that negative interest rates were not on the cards anytime soon. The FTSE 100 index declined 1% to settle at 5860.3, whereas the FTSE AIM 100 index rose 0.2% to close at 4980.8. Meanwhile, the FTSE techMARK 100 index lost 1.2% to end at 5737.9.

US markets ended lower in the previous week, as concerns about another wave of coronavirus cases and uncertainty about the outcome of the US Presidential elections weighed on investors. Meanwhile, US House Speaker, Nancy Pelosi, stated that progress was being made in negotiations with the White House, but cautioned that a bill may still take longer to write and get passed by the Congress. On the data front, both US services and manufacturing PMIs rose in October, recording the fastest rate of expansion in twenty months. Separately, the Federal Reserve’s Beige Book report for early October showed that most regions of the US continued to show slight to modest growth in economic activity. The DJIA index fell 0.9% to end at 28335.6, while the NASDAQ index lost 1.1% to close at 11548.3.