DS Smith and Johnson Matthey gained 11.3% and 10.4%, respectively.

Frontier Developments, down 10.1%, announced the release of Planet Coaster: Console Edition on current and next-generation platforms.

Kier Group, up 37%, announced that it has been selected to deliver a £59m major infrastructure project at Sellafield.

Checkit, up 5.6%, in its trading update for the nine months to 31 October 2020, announced that its trading performance was ahead of the Board's expectations during Q3 FY21. The firm’s Connect Recurring revenues for Q3 FY21 grew 30% compared to the prior period, continuing the trend reported in the group's interim results.

Bango, up 4.9%, announced that it has expanded its partnership agreement with Microsoft to open-up access to Xbox subscriptions and consoles sales.

LPA Group, up 3.4%, in its trading update, announced that it traded profitably throughout the second half of the year, delivering satisfactory results and posted improved profit before tax, compared to H1 2020.

1Spatial, up 1.9%, announced that it has made new annual awards under its Employee Share Plan and revised the performance targets applying to certain awards made in 2018.

Sareum, down 34.5%, announced that the amended terms to the 2016 licensing agreement between Sierra Oncology Inc. and CRT Pioneer Fund LP for the Chk1 inhibitor SRA737 (the CRT License Agreement) have been agreed between the two parties.

Oracle Power, down 4%, announced today the acquisition of two highly prospective gold projects in Western Australia.

GRC International Group remained unchanged at 24p. The firm announced that IT Governance, its leading global provider of cyber risk and privacy management solutions, has released a new Cyber Security as a Service (CSaaS) solution, which will secure organisations against common cyber threats, whilst saving them time and money.

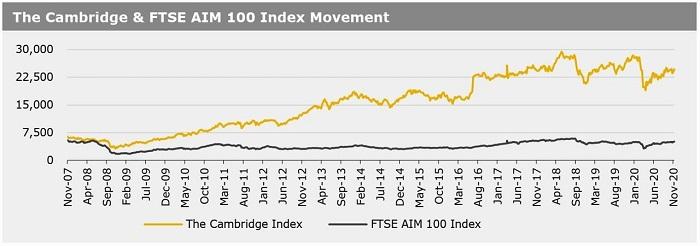

UK markets ended higher last week, as optimism about an effective COVID-19 vaccine bolstered hopes of a swift economic recovery. On the data front, the UK economy grew by a record in 3Q 2020, boosted by robust output in the services, production, and construction sectors. On the other hand, British unemployment rate increased and layoffs hit a record high during the three months to September, as the coronavirus pandemic continued to dent the jobs market. Separately, the Bank of England Governor, Andrew Bailey, stated that the central bank policymakers have discussed about the yield curve control as a way to keep interest rates low, but there is little need for it at the moment. The FTSE 100 index jumped 6.9% to settle at 6316.4, while the FTSE AIM 100 index rose 1.1% to close at 5072.7. Meanwhile, the FTSE techMARK 100 index climbed 4.5% to end at 5850.8.

US markets ended mixed in the previous week, as investors expressed concerns about surging COVID-19 cases and new curfews. Meanwhile, investors cheered the first positive data from a late-stage COVID-19 vaccine trial. On the macro front, the US consumer price inflation slowed on a monthly basis in October. Further, US consumer sentiment unexpectedly dropped in November, as American households worried about their finances, the resurgent pandemic and the depleted fiscal stimulus, thus dimming the economy's outlook. Separately, the Federal Reserve Chairman, Jerome Powell, stated that the development of an effective COVID-19 vaccine sounded good, but that it is not an immediate panacea for the economy. The DJIA index rose 4.1% to end at 29479.8, while the NASDAQ index lost 0.6% to close at 11829.3.