AVEVA Group, down 0.7%, announced that the seven for nine rights issue of 125,739,796 Rights Issue Shares at 2,255p per Rights Issue Share, announced on 6 November 2020, closed for acceptances at 11.00 a.m. on 9 December 2020. The company received valid acceptances in respect of 124,614,787 Rights Issue Shares, representing approximately 99.1% of the total number of Rights Issue Shares to be issued pursuant to the fully committed and underwritten Rights Issue.

DS Smith, up 5.8%, in its half year results, announced that its revenue stood at £2.89b, down from £3.19b recorded in the same period of the previous year. Profit before income tax narrowed to £97m from £213m.

SDI Group, up 8.5%, in its interim results for the six months ended 31 October 2020, stated that its revenue stood at £14.13m, up from £11.45m recorded in the same period of the previous year. Profit before tax widened to £2.37m from £1.52m.

Marshall Motor, up 8.5%, in its trading statement, announced that it now expects an underlying profit before tax for the year ending 31 December 2020 of not less than £19m, compared to the previously given figure of £15m.

Quixant, up 5.1%, in its trading update, announced that the group now expects to report full year adjusted profit before tax of at least $1m on revenue of at least $61m.

Amino Technologies, up 4.3%, in its trading update for the year ended 30 November 2020, announced that it expects total revenue of approximately $83m, representing an approximate 8% increase to last year.

Gaming Realms, down 11.9%, in its trading update, announced that its revenue for the year ended 31 December 2020 is expected to be £10.7m, which is around 55% ahead of that recorded in 2019.

Sareum Holdings, down 5.5%, announced today that a multi-centre analysis of DNA samples from patients with severe forms of COVID-19, including symptoms caused by the over-active inflammatory response (cytokine storm), has identified TYK2 as a key causative genetic mechanism and a potential target for therapy.

Oracle Power, down 4.2%, announced the completion of its field-based exploration programme at the Northern Zone Gold Project.

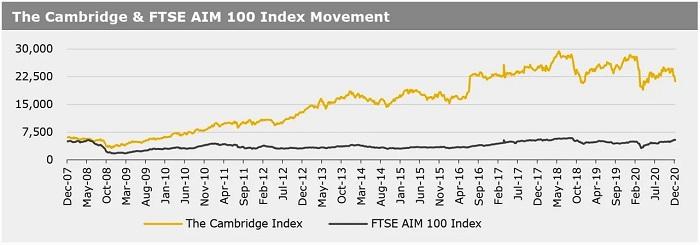

UK markets ended lower last week, after British Prime Minister, Boris Johnson, warned that there was a “strong possibility” of a no-deal Brexit. Britain became the first Western nation to begin mass vaccinations and the first globally to administer the Pfizer/BioNTech shot. On the data front, Britain’s economic recovery almost ground to a halt in October. In contrast, UK house prices rose more than expected in November. The FTSE 100 index declined 0.1% to settle at 6546.8, while the FTSE AIM 100 index fell 0.7% to close at 5405.1. Also, the FTSE techMARK 100 index lost 0.8% to end at 6119.5.

US markets ended lower in the previous week, as few signs of progress on another fiscal stimulus package in Congress weighed on investor sentiment. The US Democrat House Speaker, Nancy Pelosi, indicated that wrangling over the spending package could drag on through Christmas. On Tuesday, both the S&P 500 index and the Nasdaq Composite index had closed at a new record high. On the macro front, the number of Americans filing new jobless claims jumped to a near three-month high last week. In contrast, US consumer prices rose in line with investor expectations on a monthly basis in November. The DJIA index fell 0.6% to end at 30046.4, while the NASDAQ index lost 0.7% to close at 12377.9.