DS Smith, up 0.5%, announced that revenues fell to £5,976.0m from £6,043.0m recorded in the previous year. Also, the board declared a final dividend of 8.1p.

Dialight, up 14.2%, announced that Stephen Bird would retire as Non-Executive Director and Senior Independent Director, with effect from 10 September 2021.

Kier Group, up 10.2%, announced that it has been selected by Openreach to build full fibre broadband in additional locations across the UK.

Tristel, up 6.8%, announced that it has received regulatory approval from the US Environmental Protection Agency (EPA) for its foam-based disinfectant for surfaces, Health Canada for Tristel Duo OPH and the South Korea Ministry of Food and Drug Safety for the Tristel Sporicidal Wipe.

LPA Group, up 2.9%, announced that it has won a contract to supply 165 new build carriages with LED lighting systems, for the UK's East Midlands Railway Aurora InterCity Fleet.

Gaming Realms, up 2.1%, announced that it has secured a licensing deal with International Game Technology Plc to produce Slingo games.

Marshall Motor, up 1.8%, announced that having achieved strong progress in the new and used vehicle markets, the Group now expects to deliver robust first half performance in both profit and cash generation.

1Spatial, up 1.2%, announced that it has made good progress for the period by acquiring new customers.

CyanConnode, down 5.7%, announced the appointment of Rajiv Kumar as Managing Director and CEO of CyanConnode India, while Ajoy Rajani as Vice Chairman.

Cambridge Cognition, down 3.5%, announced today that it has been chosen as the cognitive assessment partner for at-home cognitive testing contract worth £2.2m.

Sareum, down 3.4%, announced that its CEO, Dr Tim Mitchell, would give a company presentation at the BioTrinity 2021 conference.

Bango, down 0.9%, announced the expansion of its latest Xbox Game Pass telco bundle offering into Netherlands.

Aferian, down 0.3%, announced that it is changing its name to Aferian Plc.

Oracle Power, unchanged at 0.5p, announced that pre-tax loss narrowed to £1.01m from £1.09m recorded in the prior year.

UK markets ended higher last week, amid hopes that Britain’s economy would reopen quicker than its peers. On the data front, UK’s house prices registered its biggest seasonal increase since 2015 in June, while the nation’s public sector net borrowings fell in May, as easing lockdown restrictions boosted the economy and tax revenues. On the other hand, the UK manufacturing and services PMIs both fell in June.

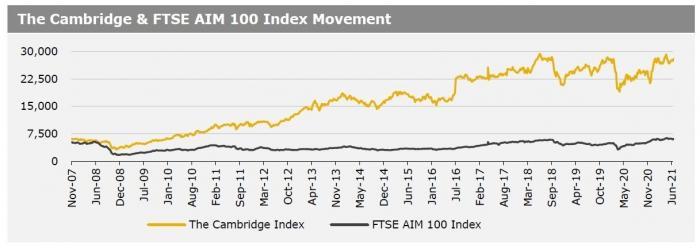

Separately, the Bank of England (BoE) left its key interest rate unchanged at 0.1% and stated that it expects inflation to exceed 3% by the end of the year. Moreover, the BoE estimated that growth in the second quarter would be about 1.5%, higher than previously expected. The FTSE 100 index advanced 1.7% to settle at 7136.1, while the FTSE AIM 100 index rose 2.5% to close at 6141.9. Also, the FTSE techMARK 100 index gained 1.3% to end at 6856.7.

US markets ended higher in the previous week, after US President Joe Biden reached a $1.2t infrastructure deal. On the macro front, the US economy grew as expected in 1Q 2021, while the nation’s durable goods orders grew at its fastest pace since January in May, bolstered by increased orders for commercial planes. On the contrary, the US existing home sales fell for a fourth straight month in May, due to soaring prices and tight supply of construction material, while new homes sales fell to a one-year low in May, amid record high prices of raw material. Moreover, the US initial jobless claims fell less than expected in the week ended 18 June 2021. Further, US Federal Reserve, Chairman, Jerome Powell, pledged not to raise interest rates anytime soon and reiterated that current price increases would soon subside. The DJIA index rose 3.4% to end at 34433.8, while the NASDAQ index gained 2.4% to close at 14360.4.