AVEVA Group, down 3.2%, in its trading update, announced that its revenue rose by around 9% in the first half of the year. Further, the company intends to release its results for the six months ended 30 September 2021 on 10 November 2021.

DS Smith, up 2.4%, in its pre-close trading update announced that its performance has been in line with the board’s expectations with strong box volume growth, good cost recovery and an enhanced performance from its US business.

Abcam, up 0.5%, announced that it has completed the acquisition of BioVision from Boai NKY Medical Holdings Ltd. for a consideration of $340m.

Bango, down 7.0%, today announced that it is powering the first telecommunications company (telco) to offer bundled Microsoft 365 subscriptions, launching with a major global telecoms provider in the UK.

Oracle Power, down 5.4%, announced that the programme of work (PoW) for drilling of the five target areas defined at its Jundee East Gold Project, located in Western Australia, has been approved by Department of Mines Industry Resources and Safety (DMIRS).

Sareum, down 4.5%, in its audited results for the year ended 30 June 2021, announced that it reported nil revenues during the period. Loss before tax widened to £1.72m from £1.12m recorded in the previous year.

Checkit, down 2%, announced that it has secured a new contract with BP to launch its intelligent operations platform to a further 441 forecourts within Australia and New Zealand. It believes that installations for these forecourts would start early next year would double the size of Checkit's footprint within BP in terms of total number of locations and contracted annual recurring revenues.

Cambridge Cognition, down 0.4%, announced that it has won a three-year contract worth more than £600,000 for a further sizeable schizophrenia trial with an existing customer.

UK markets ended mostly lower last week, on economic growth concerns. On the data front, the BRC shop prices declined at a slower pace in October while the nation’s mortgage lending jumped to its highest level since June in September. In major news, UK Chancellor Rishi Sunak raised the consumer spending by a massive £150b to support a strong economic recovery after the crisis caused by the coronavirus pandemic. Moreover, citing the latest projections from the Office for Budget Responsibility (OBR), he said Britain’s economy is forecast to grow 6.5% in 2021.

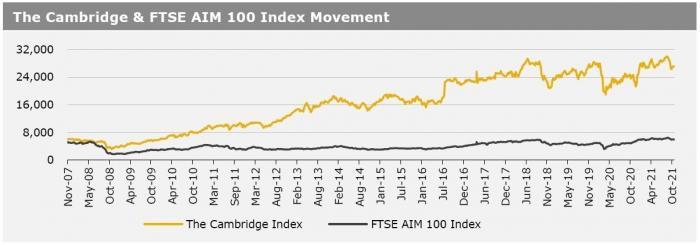

The FTSE techMARK 100 index lost 2% to end at 7032.4, while the FTSE AIM 100 index fell 1% to close at 5988.4. Meanwhile, the FTSE 100 index advanced 0.5% to settle at 7237.6.

US markets ended higher in the previous week, following robust corporate earnings reports. On the macro front, the nation’s weekly jobless claims declined for the fourth straight week in the week ended 22 October 2021, while consumer confidence index rose for the first time four months in October, as concerns about the delta variant of the coronavirus faded. Meanwhile, the US economy grew at a weaker than expected pace in 3Q 2021, amid slowdown in consumer spending, while durable goods orders fell in September, amid disruption in the supply of material and labour shortages. Also, the US pending home sales unexpectedly dropped in September, as some potential buyers delayed purchases amid higher mortgage rates. The DJIA index rose 0.4% to end at 35819.6, while the NASDAQ index gained 2.7% to close at 15498.4.