DS Smith, up 0.2%, announced that overall trading continues to be in line with expectations and is progressing well.

Abcam, down 9.7%, announced that it has expanded its presence in China with the opening of new custom-built facilities in Hangzhou and Shanghai.

1Spatial, up 4.5%, announced that it expects to report strong progress in key financial metrics, delivering results ahead of current market expectations due to a robust performance in the second half of the year. Revenue for the year is expected to exceed £24m and adjusted EBITDA is expected to be more than £3.2m.

Bango, up 3.4%, announced that Chief Financial Officer Carolyn Rand has stepped down from the Board and her position. As a result, the company has appointed Matthew (Matt) Jonathan Garner as Chief Financial Officer.

Oracle Power, up 2.4%, announced that it has appointed David Hutchins as a Non-Executive Director, with immediate effect. Today, the company announced that the recent gravity survey conducted across the Jundee East Gold Project in Western Australia has confirmed the presence of a newly identified substantial greenstone belt located directly adjacent and east of the Jundee Gold Mine.

Quartix Holdings, down 4.9%, announced in its final results for the year ended 31 December 2020, that revenues rose to £25.84m from £25.62m recorded in the previous year. Profit before tax narrowed to £5.66m from £6.45m. The Board is recommending a final ordinary dividend of 2.40p per share.

Marshall Motor Holdings, down 0.3%, announced that it will release its full year results for the year ended 31 December 2020 on 9 March 2021.

IQGeo Group remained unchanged at 98.5p, announced that Richard Petti and Haywood Chapman will provide a live presentation via the Investor Meet Company platform on 25th March 2021 at 4:30pm GMT.

UK markets closed mostly higher last week, amid hopes over stronger than expected UK economic recovery and optimism over Britain’s budget statement in which the government announced an extension to emergency aid programmes. On the macro front, UK’s manufacturing PMI climbed to a two-month high in February, while the nation’s house price inflation accelerated in February. Further, the UK construction PMI expanded in February, driven by sharp rise in commercial development activity since last September.

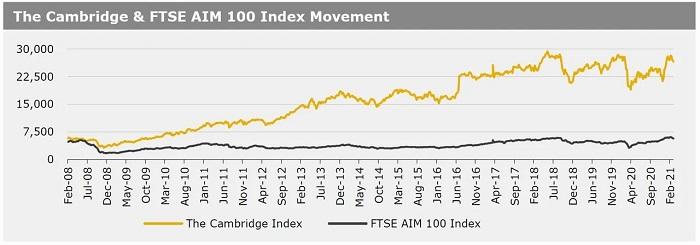

On the flipside, the UK services PMI rose less than expected in February, while the nation’s Halifax house prices dropped for a second straight month in February. In major news, British Finance Minister Rishi Sunak announced an additional £65b in fiscal aid. Also, the UK government expects the economy to expand by 7.3% next year, returning to pre-Covid levels by mid-2022. The FTSE 100 index rose 2.3% to settle at 6630.5, while the FTSE techMARK 100 index gained 1.4% to end at 6258.5. Meanwhile, the FTSE AIM 100 index fell 2.4% to close at 5740.0.

US markets ended mixed last week, as stronger than expected growth in US jobs offset concerns over higher inflation and rising bond yields. On the data front, the US services PMI unexpectedly fell in February, due to a slowdown in the pace of growth in new orders while trade deficit widened in January as imports rose more than exports. Meanwhile, the US factory orders advanced in January, while the nation’s manufacturing PMI jumped in February. Additionally, the US initial claims rose less than expected in the week ended 26 February. Furthermore, the US nonfarm payrolls jumped more than expected in February, amid rise in employment in the leisure and hospitality industry while the nation’s jobless rate unexpectedly fell in February.

In other news, Federal Reserve Chairman Jerome Powell stated that reopening of the US economy could lead to higher inflation, but the central bank would maintain its loose monetary policy. The DJIA index rose 1.8% to end at 31496.3, while the NASDAQ index lost 2.1% to close at 12920.2.