AVEVA Group, down 4.5%, signed an agreement worth £2.6m ($3.7m) with Schneider Electric for the sale of three of its businesses.

Kier Group, up 24.3%, successfully raised gross proceeds of around £241m through a placing of 284,049,829 new ordinary shares at an issue price of 85.0p per share.

1Spatial, up 3.6%, today announced that it has been awarded a UK Patent for Modification and Validation of its data.

GRC International Group, unchanged at 32.5p, announced that Executive Director, Steve Watkins would step down from his position, with immediate effect.

Gaming Realms, down 15.7%, entered into a four-year licensing agreement with Scientific Games, a world leader in gaming entertainment, thereby extending its existing agreement.

Amino Technologies, down 11.8%, announced that its proposal in the auction to acquire the trade and certain assets of MobiTV, Inc. and MobiTV Services Corporation (together MobiTV) has not resulted in Amino being selected as the successful bidder, but instead as the reserve bidder.

Checkit, down 4.7%, in its trading update for the three months to 30 April 2021, indicated that overall group revenue grew by 15%, while recurring revenue rose by 29% compared to the last year, reflecting the benefits of year-on-year annual recurring revenue (ARR) growth realised in the quarter.

SDI Group, down 2.3%, announced that it would release its final results for the year ended 30 April 2021 on 20 July 2021. It expects to publish a post year-end trading update on 26 May 2021.

Bango, down 1.6%, announced that it has entered into a partnership with NTT DATA Hong Kong (NTT DATA), to expand their footprint in the key Asian markets. As a result of this agreement, wallet providers across Asia can attract more users by partnering with Bango merchants to bundle product offers as sign-up incentives and loyalty rewards, acquiring new customers based on purchase behaviour targeting.

UK markets ended lower last week, amid concerns over rising inflation. On the data front, UK’s gross domestic product fell less than expected in the first quarter of 2021, while the British economy grew stronger-than-expected on a monthly basis in March, as coronavirus restrictions eased. Additionally, the nation’s house prices rose to a five-year high in April, helped by Finance Minister Rishi Sunak’s extension of tax cut for home buyers.

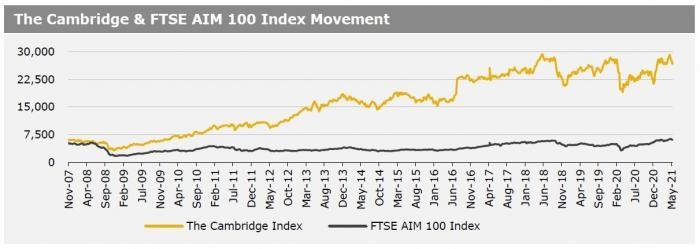

Britain’s retail sales accelerated in April, as Prime Minister Boris Johnson allowed non-essential stores to reopen. Moreover, UK’s industrial production and manufacturing production, both, climbed in March. The FTSE 100 index declined 1.2% to settle at 7043.6, while the FTSE AIM 100 index fell 2.4% to close at 6073.6. The FTSE techMARK 100 index lost 2.9% to end at 6499.5.

US markets ended lower in the previous week, amid fears that rising inflation would prompt the US Federal Reserve to tighten monetary policy sooner than expected. On the macro front, US retail sales stalled in April, as the boost from stimulus checks faded, while the nation’s consumer sentiment unexpectedly dropped in May, amid concerns over rising prices. Additionally, US consumer prices in April grew at their fastest pace since 2008, fuelling concerns that the world’s largest economy is overheating.

US jobless claims fell to a 14-month low in the week ended 7 May 2021, as companies held onto their workers, due to labour shortage. The DJIA index fell 1.1% to end at 34382.1, while the NASDAQ index declined 2.3% to close at 13430.