Abcam, down 0.4%, announced that it would publish its interim results for the six months ended 31 December 2020 on 8 March 2021.

Feedback, up 20.9%, announced that first half revenues fell to £0.17m from £0.27m recorded in the same period a year ago.

Netcall, up 10.5%, announced that first half revenues stood at £13.35m, up from £12.26m recorded in the same period a year ago.

1Spatial, up 8.1% to 33.5p, announced that it expects revenue for the period to exceed £24m and adjusted EBITDA to be in excess of £3.2m.

Amino Technologies, up 1%, announced the rollout of a next generation digital experience PayTV+ for GO Malta (GO), Malta's leading communications services company and Cablenet.

Quixant, up 0.4%, announced that it would release its final results for the year ended 31 December 2020 on 12 April 2021.

Oracle, down 9.8%, announced that following the submission of the policy proposal for coal-to-gas and coal-to-liquid development in Pakistan to the Ministry of Energy on 2 February 2021, the Ministry has elected to move ahead with a consultative session in early March to mobilise the policy proposal process.

Bango, down 5.9%, announced that Carolyn Rand has resigned as Chief Financial Officer.

Tristel, down 1.7%, announced that revenues rose to £16.75m from £14.63m recorded in the same period previous year. The Board has proposed an interim dividend of 2.62p (2020: 2.34p) per share.

Quartix, which remained unchanged at 470p, announced that revenues increased to £25.84m from £25.62m recorded in the previous year. The Board has declared a final ordinary dividend of 2.40p per share, along with a supplementary dividend of 15.30p per share.

UK markets ended lower last week, amid concerns over rising inflation. On the data front, Britain’s unemployment rose to a 5-year high in the three months to December, as fresh coronavirus-led lockdown restrictions shut down several businesses across the country. On the contrary, the nation’s average earnings including bonus climbed more than expected on an annual basis in the same period.

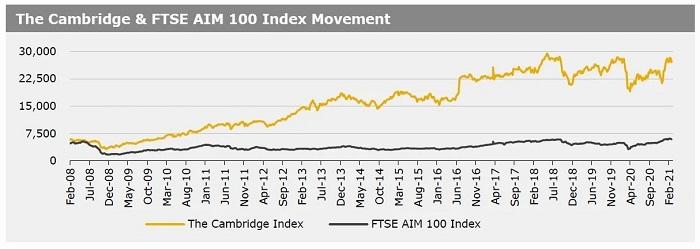

In a key development, UK Prime Minister, Boris Johnson unveiled a four-step plan to ease lockdown and reopen the economy in June. Also, he stated that he was very optimistic that all Covid-19 restrictions in England would end on 21 June. The FTSE 100 index declined 2.1% to settle at 6483.4, while the FTSE AIM 100 index fell 2.9% to close at 5881.9. Also, the FTSE techMARK 100 index lost 2.3% to end at 6169.1.

US markets ended lower in the previous week, amid ongoing worries over rising US Treasury yields. On the macro front, the US gross domestic product grew more than initially estimated in the fourth quarter of 2020, while durable goods climbed by the most in six months in January, driven by increase in demand for civilian aircraft. Additionally, the US consumer sentiment rose to a three-month high in February, amid optimism over vaccine rollout while the nation’s weekly jobless claims dropped more than expected in the week ended 19 February. Also, the Chicago Fed National Activity Index climbed more than expected in January, while the nation’s new home sales accelerated more than expected in January. Further, the US consumer sentiment index dropped less than initially estimated in February.

Meanwhile, the US pending home sales fell to a six-month low in January. In major news, US Federal Reserve, Chairman Jerome Powell, during his testimony, reiterated that the central bank would maintain its accommodative policy stance. Further, he pledged to provide monetary support and stated that interest rates would remain low until inflation exceeds 2%. The DJIA index fell 1.8% to end at 30932.4, while the NASDAQ index lost 4.9% to close at 13192.3.