Abcam, up 2.2%, announced that it has closed its offering of an aggregate of 10,287,000 American Depositary Shares (ADSs), representing 10,287,000 ordinary shares at a price of $17.50 per ADS.

Frontier Developments, up 0.6%, announced that its game Elite Dangerous: Horizons, the major expansion for the long-running space epic, is now available for free for all owners of Elite Dangerous for download on PC, the PlayStation®4 computer entertainment system and the Xbox One all-in-one games and entertainment system.

Sareum Holdings, up 24.6%, announced that its application for approximately £174,000 grant award by UK Research & Innovation to investigate the therapeutic potential of SDC-1801, its selective, small molecule TYK2/JAK1 kinase inhibitor, in severe phase COVID-19, has been conditionally approved.

IQGeo Group remained unchanged at 69p. The company announced that its registered office is now located at Nine Hills Road, Cambridge, CB2 1GE.

Horizon Discovery Group, down 5.5%, today announced that it has reached an agreement with PerkinElmer Inc on the terms of a recommended all cash offer, whereby the entire issued and to be issued ordinary share capital of Horizon will be acquired by PerkinElmer (UK) Holdings Limited.

Oracle Power, down 3.8%, in its unaudited interim results for the six months ended 30 June 2020, stated that its operating loss narrowed to £364,591 from £475,048 in the corresponding period of the previous year. Its diluted loss per share came in at 0.02p, compared to 0.04p.

SDI Group, down 3.4%, announced that its website is now www.thesdigroup.net and that it contains all information required pursuant to AIM Rule 26.

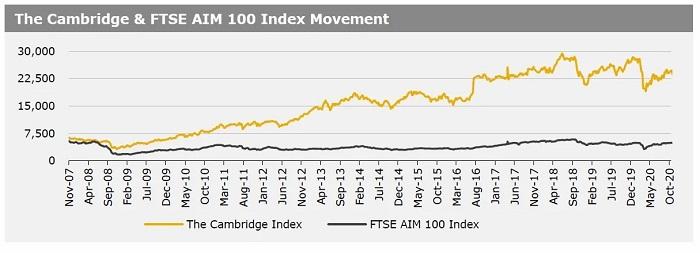

UK markets ended sharply lower last week, as a new wave of regional COVID-19 restrictions threatened a nascent British economic recovery. On the data front, British annual house price growth accelerated to a 5-year high in October. Data from the Bank of England (BoE) showed that mortgage approvals hit their highest level in 13 years, while consumer credit weakened in September. Meanwhile, the BoE announced that it is in consultation with British banks about potentially allowing them to resume paying dividends. Separately, the European Union’s (EU) Chief Negotiator, Michel Barnier, stated that the EU and Britain are working hard for a Brexit trade deal, but much remains to be done. The FTSE 100 index declined 4.8% to settle at 5577.3, while the FTSE AIM 100 index fell 3.1% to close at 4827.6. Also, the FTSE techMARK 100 index slumped 5.9% to end at 5397.

US markets ended lower in the previous week, due to a surge in coronavirus cases in the US and Europe and as uncertainty over the outcome of US election rattled investors. Also, a final agreement on a new round of fiscal spending remained elusive. Data showed that US pending home sales unexpectedly pulled back off a record high in the month of September, indicating a slowdown in homebuyer demand, while new home sales unexpectedly dropped in September. In contrast, the US economy bounced back in 3Q 2020 from the collapse in activity seen in the preceding three months, after the government poured out more than $3 trillion of pandemic aid. A separate report showed that weekly unemployment claims fell last week. Moreover, US durable goods orders advanced for the fifth consecutive month in September. The DJIA index tumbled 6.5% to end at 26501.6, while the NASDAQ index dropped 5.5% to close at 10911.6.