AVEVA Group, down 1.8%, announced that Hilary Maxson has been nominated to replace Peter Herweck as a Non-Executive Director of AVEVA and as a member of the Nomination Committee, with effect from 1 August 2021. Further, AVEVA expects to release its half year results on 9 November 2021.

Johnson Matthey, down 3.4%, in its trading update announced that trading has progressed well in the first quarter, with momentum continuing in the second half of 2020/21.

Abcam, up 2.3%, today, announced that it has agreed to acquire BioVision Inc, a subsidiary of Boai NKY Medical Holdings Ltd for $340m.

Sareum, up 17.6%, announced that it has received the US Patent and Trademark Office Notice of Allowance for a patent in respect of its proprietary SDC-1802 TYK2/JAK1 Kinase Inhibitor Programme.

Science Group, up 6%, in its interim results for the six-month period ended 30 June 2021, announced that revenues climbed to £40.66m from £36.90m recorded in the same period last year.

Dialight, up 4.3%, in its half year results for the period ended 30 June 2021, announced today that revenues rose to £60.2m from £55.2m recorded in the same period last year. The Directors have not declared an interim dividend for 2021.

Oracle Power, up 2.5%, announced that it has appointed Edward Mead as Exploration Manager for Oracle's Western Australian gold projects.

Quixant, up 2.1%, in its trading statement announced that it expects revenue to double compared to the same period last year and profits to be in line with the board’s expectations.

Quartix Technologies, down 5.5%, in its unaudited results for the half year ended 30 June 2021, announced that revenues fell to £12.49m from £13.10m recorded in the same period previous year. The Board has declared an interim dividend of 1.50p per share.

CyanConnode, down 2%, today announced that it has won a contract from Schneider Electric (Schneider Electric India Pvt Limited) for a smart metering deployment in Northern India.

Aferian, down 0.3%, announced that it would conduct a live presentation relating to its interim results on 4 August at 12.30pm.

UK markets ended higher last week, after England scrapped some quarantine rules for fully vaccinated EU, US visitors. On the data front, British house prices dropped in July, amid tapering of stamp duty relief in England while the nation’s shop prices fell in July, driven by steep decline in non-food prices. Additionally, UK’s mortgage approvals dropped to its lowest level in almost a year in June.

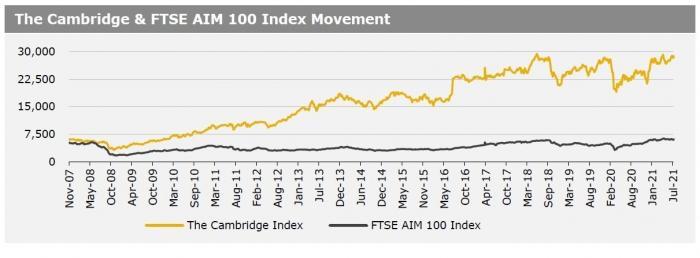

The FTSE 100 index advanced 0.1% to settle at 7032.3, while the FTSE AIM 100 index rose 1.7% to close at 6189.4. Also, the FTSE techMARK 100 index gained 0.2% to end at 6989.3.

US markets ended lower in the previous week, after the Federal Reserve (Fed) failed to provide clarity about the timing of reducing its bond purchase. On the macro front, US home sales dropped to a 14-month low in June, driven by shortages of building material, while pending home sales unexpectedly fell in the month of June, amid spike in home prices. Also, the US consumer sentiment index dropped to a five-month low in July, amid ongoing concerns over rising inflation.

Meanwhile, the US economy grew in the second quarter of 2021, as huge government aid and vaccination rollouts fuelled spending on travel businesses, while the nation’s durable goods orders climbed in June, helped by rise in orders for commercial aircraft and parts. Additionally, the US consumer confidence index climbed to a 16-month in July, amid optimism over business and labour market conditions, while initial jobless claims fell in the week ended 23 July 2021. Separately, the Fed left its key interest rate unchanged at 0.25% and indicated that it has made ‘progress’ towards its inflation and employment goals. The DJIA index fell 0.4% to end at 34935.5, while the NASDAQ index lost 1.1% to close at 14672.7.