Johnson Matthey, down 4.5%, announced that it had conducted an investor and analyst call on 18 September 2020, wherein it provided insights into the firm’s hydrogen business and its competitive positioning.

Abcam, down 9.4%, in its preliminary results for the 12 months ended 30 June 2020, stated that its revenue came in at £260m. Its diluted earnings per share declined to 6p from 21.8p.

Cambridge Cognition, up 16.9%, announced the appointment of Richard Bungay as a Non-Executive Director.

Kier Group, up 7.6%, in its results for the year ended 30 June 2020, stated that revenue declined to £3.42b from £3.95b recorded in the previous year. Its diluted loss per share came in at 168.9p, compared to 158.5p.

IQGeo Group, up 6.7%, in its interim results for the six months ended 30 June 2020, stated that its revenue advanced to £4.72m from £3.65m recorded in the same period of the preceding year. Its loss before tax narrowed to £1.68m from £3.16m.

GRC International Group remained unchanged at 24p. The firm announced today, in its preliminary results for the year ended 31 March 2020, that its revenue dropped to £14.15m from £15.84m recorded in the previous year. Its diluted loss per share came in at 4.67p, compared to 9.30p.

Oracle Power, down 18.2%, announced that it has referred to its earlier announcement related to the presentation of the Thar Block VI project implementation plan to the Private Power and Infrastructure Board and stated that further updates in respect of the timing, and next steps required, with regard to the issuance of the LOI will be made in due course.

Checkit, down 4.3%, in its unaudited results for the six months ended 31 July 2020, stated that its revenues jumped to £6.4m from £3.2m recorded in the same period of last year.

Bango, down 0.3%, announced a powerful array of new Bango Marketplace partnership agreements across Asia. Separately, the company, in its unaudited interim results for the six months ended 30 June 2020, announced that its revenue grew to £4.77m, from £3.19m in the same period a year ago.

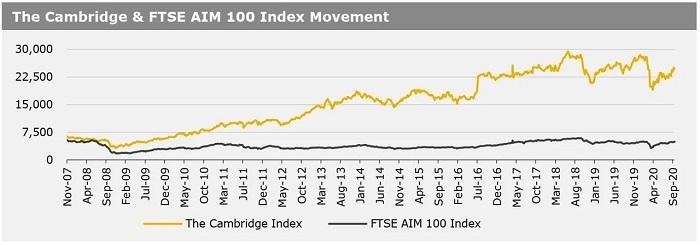

UK markets ended mostly higher last week. However, gains were muted amid concerns about rising coronavirus cases and the introduction of further mobility restrictions in Britain. The Bank of England kept the key interest rate at a record low and left its asset purchase programme unchanged. The central bank also hinted at a possible shift to negative rates amid the ongoing economic uncertainty. On the data front, UK inflation slowed in August, as a subsidy for eating out and a VAT cut for the hospitality industry reduced prices. Meanwhile, retail sales rose for the fourth consecutive month in August, as the post-lockdown recovery continues. The FTSE 100 index declined 0.4% to settle at 6,007.1, while the FTSE AIM 100 index rose 2.4% to close at 4952.4. Also, the FTSE techMARK 100 index gained 0.8% to end at 5,793.4.

US markets ended weaker in the previous week, as investors digested the Federal Reserve’s warning of a slow economic recovery. The central bank held interest rates near zero and signalled that they would stay there for at least three years. In economic news, the US industrial production and retail sales came in less than expected on a monthly basis in August. The number of Americans filing new claims for unemployment benefits fell last week but remained perched at extremely high levels. Separately, the OECD now expects the world economy to shrink by 4.5% this year, less than its June prediction for a 6% decline. The DJIA index marginally fell to end at 27657.4, while the NASDAQ index lost 0.6% to close at 10793.3.