Frontier Developments, up 0.2%, announced that it has launched “One Giant Leap”, the first in a series of Elite Dangerous: Odyssey Developer Diaries. Separately, the company announced that the latest PDLC for Planet Zoo will be available on Steam from 25 August.

Gaming Realms, up 17.3%, in its 1H 2020 trading update, stated that it has continued to trade ahead of market expectations. Revenue rose to £5m from £3.1m in the same period a year ago. The firm said its performance for the period is a result of the expansion of its partners internationally and the release of new "Slingo" games. Peel Hunt reaffirmed its “Buy” investment rating on the stock and lifted its target price to 30p from 16p.

Tristel, up 13%, announced that India's Medical Device & Diagnostics Division, Central Drugs Standard Control Organisation (CDSCO) approved its Duo high-level disinfectants for the decontamination of semi-critical medical devices.

Marshall Motor, up 4.1%, in its unaudited interim results for the six months ended 30 June 2020, announced that its revenue dropped to £895.3m from £1,183.3m in the same period a year ago.

Quixant, up 2%, announced that it has appointed Andrew Jarvis as interim Chief Financial Officer (CFO).

Horizon Discovery Group, down 6.5%, in its results for six months ended 30 June 2020, announced that its revenue declined to £22.4m from £26.1m in the same period of the previous year. Its loss before tax widened to £11.3m from £5.2m. Its basic and diluted loss per share stood at 6.1p, compared to 3.2p in the previous year. On the outlook front, the firm is confident of a return to growth in the second half of the year.

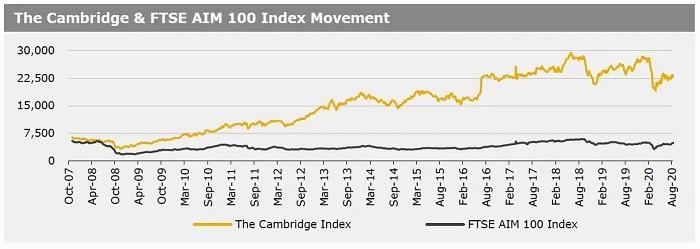

UK markets closed mostly lower last week, after the US Federal Reserve (Fed) struck a cautious note over the US economic recovery. On the data front, UK’s consumer prices improved to its highest level in 4-months in July, with clothing stores refraining from their usual summer discounts after reopening from lockdowns. Additionally, the British manufacturing sector expanded to its highest level since February 2018 in August, while the services PMI advanced at the fastest pace for seven years in the same month. The FTSE 100 index declined 1.4% to settle at 6001.9, whereas the FTSE AIM 100 index rose 0.5% to close at 4855.7. Meanwhile, the FTSE techMARK 100 index lost 2.4% to end at 5627.3.

US markets ended mixed in the previous week, after the Fed’s July monetary policy meeting minutes warned of a highly uncertain path for recovery from the global health crisis that has hammered economic growth across the world. Further, the policymakers slashed the US economic growth forecast for the remainder of 2020 and stressed the need for more fiscal aid in the wake of the coronavirus pandemic. On the data front, the US housing starts advanced by the most in nearly four years, while building permits accelerated in July. Additionally, the nation’s manufacturing PMI increased to its highest level since January 2019 in August, while services PMI climbed to its highest level since March 2019 in August. In contrast, initial jobless claims unexpectedly jumped back above the one million mark last week after slipping below that level for the first time since the start of the pandemic. The DJIA index ended marginally lower at 27930.3, while the NASDAQ index gained 2.7% to close at 11311.8.