DS Smith, down 0.8%, announced that the EU Home Member State of the company for the purposes of the EU Transparency Directive would be Luxembourg.

Cambridge Cognition, up 16.9%, announced that it witnessed a significant growth in revenues from digital solutions for clinical trials in 2020. Moreover, preliminary results for the year ended 31 December 2020 would be released on 23 March 2021.

Bango, up 10%, announced that it has entered into a strategic partnership with TPAY MOBILE FZ-LLC, to accelerate its access to digital commerce.

Gaming Realms, up 7.1%, announced that it has extended its licensing agreement with Scientific Games, for the development and distribution of games under the Rainbow Riches brand. Separately, the firm announced that it has signed a direct-integration agreement with BetMGM to expand its footprint in the US.

IQGeo Group, up 6.4%, announced that it expects to report good growth in all key metrics. Revenue for the year is expected to be not less than £9.0m. The Group had net cash of £10.5m at the year end.

Kier Group, up 5.1%, announced that the group expects to deliver half-year results slightly above the Board's expectations and is confident in the group’s outlook. Also, it expects to generate positive adjusted operating cash flow at the half year end.

Quartix, up 4.7%, announced that Chief Executive Officer, Andrew Walters, his wife and PCA, Dominie Walters, and A J Walters Trust, a trust established by Andrew Walters for the benefit of his family, have successfully sold a total of 7,194,377 placing shares at a price of 401p per placing share through an oversubscribed placing. The placing shares in aggregate represent around 15% of the company's issued share capital.

Feedback, down 11.5%, announced that it has boosted its data management security with certification of Cyber Essentials Plus and ISO 27001, for its imaging-based communication platform, Bleepa.

Amino Technologies, down 1.1%, announced that it has appointed Steve Oetegenn as a Non-Executive Director of the Group, with immediate effect.

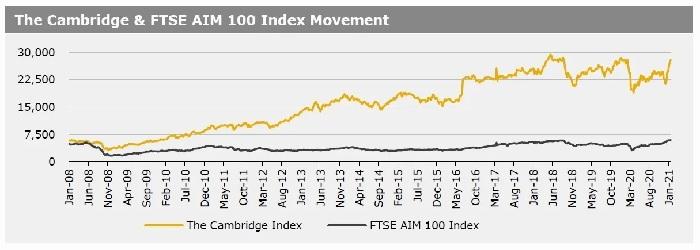

UK markets ended mostly higher last week, helped by gains in mining sector stocks. However, gains were limited amid dismal domestic economic. On the data front, UK inflation accelerated in December, driven by rise in clothing and transport prices, while UK house prices grew at its fastest pace since 2016 in November, citing increased demand after the first lockdown. Meanwhile, the GfK consumer confidence fell in January, amid concerns about the economic impact of recent lockdown restrictions in the country. Additionally, the nation’s retail sales rose less than expected in December, whereas the UK manufacturing and services PMIs dropped more than expected in January. Separately, BoE Governor, Andrew Bailey stated that he expects a “pronounced recovery” in UK’s economy amid accelerated vaccine rollouts. The FTSE 100 index declined 0.6% to settle at 6695.1, whereas the FTSE AIM 100 index gained 2% to close at 6027. Also, the FTSE techMARK 100 index rose 1.3% to end at 6441.

US markets ended higher in the previous week, following upbeat US economic data and on hopes for a larger stimulus spending by Joe Biden’s administration to support the economy. On the macro front, the US weekly jobless claims dropped more than expected in the week ended 15 January 2021, while both housing starts and building permits climbed to a 14-year high level in December, amid robust demand for single-family housing. Also, the US manufacturing and services PMIs unexpectedly climbed in January. Additionally, existing home sales jumped to a 14-year high in December. The DJIA index rose 0.6% to end at 30997, while the NASDAQ index gained 4.2% to close at 13543.1.