Johnson Matthey, up 2.4%, announced that Chinese company, Zibo Qixiang Tengda Chemical Company Ltd. (QXTD), has selected LP OxoSM Technology at its new manufacturing facility to produce isononyl alcohol. Liberum Capital downgraded its rating on the stock to “Hold” from “Buy” with a target price of 2100p. JP Morgan Cazenove upgraded its rating on the stock to “Buy” from “Neutral”.

Frontier Developments, up 2.2%, launched a major expansion for its Elite Dangerous game, which will arrive in early 2021.

CyanConnode, up 76.7%, announced that it has now received the required approvals to resume the implementation of a substantial Indian contract, which had been delayed. Separately, the company stated that the Thai contract deliveries and payments received against them were in line with expectations.

Gaming Realms, up 17.5%, in its trading update for the five months ended 31 May 2020, announced that licensing revenue was up 80% during the period, while its social division revenues were 15% higher. The board expects EBITDA for the period to be significantly ahead of current market expectations.

Bango, up 6.8%, announced that the deployment of its payment optimisation technology has helped UAE-based mobile operator, du, to grow its active carrier billing customer base by 20%.

Marshall Motor, up 6.7%, in its trading statement, announced that the group is confident of achieving good operational and financial performance in the first quarter of the current financial year.

Feedback, up 4.8%, announced that its Bleepa imaging technology has achieved CE mark for Europe, in compliance with the Medical Device Directive (MD Directive).

Dialight, up 3.2%, announced that it has appointed Wai Kuen Chiang as a Chief Financial Officer (CFO) and Executive Director of the Group.

Amino Technologies, down 0.7%, announced today that its half-yearly revenues are expected to be higher than H1 2019, driven by software and services.

Checkit, down 0.7%, announced that its Annual General Meeting (AGM) will be held on 31 July 2020 instead of 9 July 2020, with a delay in the publication of results to 16 June 2020.

Xaar, down 3.6%, announced that trading for the first four months of 2020 was in line with expectations but outlook for its second half remains uncertain.

Oracle Power, down 3.8%, announced that it has paid evaluation fee of $50,000 in full to the Private Power and Infrastructure Board and received $7,491 from Sheikh Ahmed Dalmook Al Maktoum’s private office in respect of the office’s share of the evaluation fee.

Quartix, down 8.2%, announced that trading for the four months to 30 April 2020 was strong and ahead of the last year, with cash balance of £9.5m.

Cambridge Cognition, down 8.6% announced that it will host Capital Markets Showcase through Webex on 30 June 2020.

Sareum Holdings, down 25.7%, announced that it has raised £0.72m via a placement by Hybridan LLP of 119.8m new ordinary shares at 0.6p per share in the capital of the company.

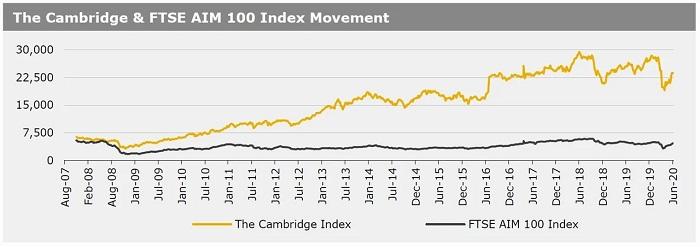

UK markets closed higher last week, as gradual reopening of lockdown restrictions raised hopes of a rebound from coronavirus crisis. On the data front, the UK manufacturing sector activity rose in May, while the services PMI climbed more than expected in May. Meanwhile, British house prices declined at the fastest pace since February 2009 in May, while the consumer confidence fell to a January 2009-low in May. The FTSE 100 index advanced 6.7% to settle at 6484.3, while the FTSE AIM 100 index rose 3.7% to close at 4665.9. Additionally, the FTSE techMARK 100 index climbed 6.3% to end at 5501.6.

US markets ended firmer in the previous week, supported by gains in energy and industrial sector stocks. In economic news, US manufacturing and services PMIs climbed in May, while weekly jobless claims dropped less than expected in the last week. Moreover, the US nonfarm payrolls unexpectedly advanced in May, while unemployment rate dropped in the same month. The DJIA index jumped 6.8% to end at 27111, while the NASDAQ index also gained 3.4% to close at 9814.1.