Jefferies International reiterated its “Buy” rating on DS Smith, up 10.3%, with a target price of 350p.

Frontier Developments, up 20.8%, in its trading update for the financial year ending 31 May 2020, announced that it expects operating profit and revenue for the period to be ahead of previous range of £11-13m and £65-73m, respectively. The company has witnessed high demand for its immersive and creative games in May, providing a strong finish to the financial year. Frontier is likely to announce its results for the financial year ending 31 May 2020 on 8 June 2020. Peel Hunt increased its target price on the stock to 2073p from 1500p and maintained its “Buy” rating. Berenberg raised its target price on the stock to 2050p from 2000p and gave a “Buy” rating.

Bango, up 29.8%, announced that it has launched carrier billing routes successfully in the Google Play store for new operators in Asia, Latin America and Africa. Customers from these countries can now pay for content and services in Google Play by charging the cost to their phone bill using Bango's platform. Separately, the company stated that all resolutions were duly passed at its Annual General Meeting (AGM).

Quixant, up 15.6%, in its trading update, announced that staff health and wellbeing is their top priority, as all member working remotely, wherever appropriate. However, the company witnessed positive signs of recovery, and started to see first reopening of its venues in the US and robust attendance from players. Further, the board mentioned that gradual reopening of more of the economy will lead to multiple opportunities across the Gaming and Densitron businesses and deliver long term growth. Separately, the company announced that all resolutions were duly passed at its AGM.

Kier Group, up 5.1%, announced that Kirsty Bashforth will step down as Non-Executive Director at its AGM in November 2020.

Horizon Discovery Group, down 3.1%, announced that its AGM will be held on 18 June 2020 at its offices ‐ Building 8100 Cambridge Research Park, Waterbeach, Cambridge, CB25 9TL. Separately, the company announced that it has entered into licence agreement with Rentschler Biopharma SE for the use of its Chosource platform. The platform would help cell line development, by combination with Rentschler's novel in-house process.

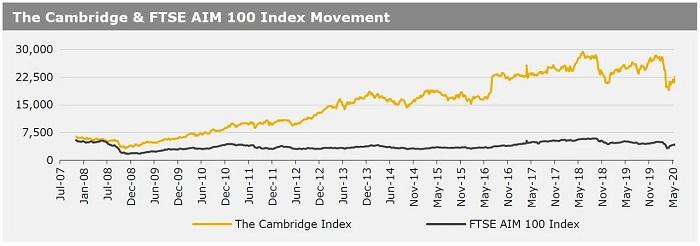

UK markets closed significantly higher in the last week, amid hopes of speedy recovery in economy during coronavirus pandemic. On the data front, the UK unemployment rate unexpectedly dropped in the three months to March period, while the nation’s consumer prices dropped to a four-year low in April. Moreover, British retail sales declined to its lowest level since 1988 in April, while the public sector net borrowing posted its biggest deficit since 1993 in April. On the contrary, UK’s manufacturing and services sector activities, both climbed more than expected in May. The FTSE 100 index advanced 3.3% to settle at 5993.3, while the FTSE AIM 100 index jumped 4.5% to close at 4319.2. Meanwhile, the FTSE techMARK 100 index gained 3.9% to end at 5191.2.

US markets ended higher in the previous week, amid expectations of additional stimulus packages by the central bank to boost the economy. In economic news, the US building permits slumped less than expected in April, while the nation’s housing starts dropped to a five-year low in the same month. On the other hand, the US manufacturing and services PMIs, both rose more than expected in May, while weekly jobless claims dropped less than expected in May. The DJIA index rose 3.3% to end at 24465.2, while the NASDAQ index gained 3.4% to close at 9324.6.