Johnson Matthey, up 1.7%, announced significant strategic developments in the commercialisation of eLNO, its portfolio of leading nickel rich advanced cathode materials. Additionally, the company announced that it has signed an agreement with SQM to supply lithium hydroxide from its Salar del Carmen plant in Antofagasta, Chile.

Quixant, up 8.5%, announced, in its final results for the year ended 31 December 2020, that revenues dropped to $63.8m from $92.3m recorded in the previous year. Loss after tax stood at $3m, compared to a profit of $8.3m. The board has recommended the payment of a dividend of 2p per share for 2020.

CyanConnode Holdings, up 1.8%, announced that it has been engaged by EESL Energy Solutions LLC, Dubai, (EESL), as technology partner for projects in the Middle East and Africa for smart metering and smart lighting projects.

Xaar, up 1.2%, announced that it would release its full year results for the year ended 31 December 2020 on 27 April 2021.

Oracle Power, down 4.5%, announced that Q1 has been a period of increased activity in both of its jurisdictions and has set the pace for a highly productive 2021. In Pakistan, it has made meaningful progress with its Thar Block VI Project, specifically with the commercialisation framework for our coal-to-gas and coal-to-liquid strategy.

1Spatial, down 4.3%, announced that Google Real Estate and Workplace Services, a division of Google, Inc., has extended its contract worth $500k for services to support the licensing of 1Spatial's rules engine, 1Integrate, and cloud portal, 1Data Gateway.

Dialight, down 3.6%, announced that Chief Financial Officer and Executive Director, Wai Kuen Chiang intends to step down from her position.

Kier Group, down 2.1%, announced that it has agreed to sell Kier Living Limited to Foster BidCo Limited for a cash consideration of £110m.

IQGeo (former Ubisense Group), down 0.4%, announced that its Annual Report and Financial Statements for the year ended 31 December 2020 have been posted on the Company's website.

Marshall Motor Holdings, down 0.3%, announced the sudden demise of its Chairman, Professor Richard Parry-Jones CBE.

UK markets ended firmer last week, after data indicated that the British economy returned to growth in February, as mass vaccinations and the prospect of easing of coronavirus restrictions lifted consumer confidence. On the data front, UK’s industrial production rose more than expected in February, while the nation’s manufacturing output rebounded in the same month. Additionally, the nation’s like-for-like retail sales surged in March, driven by sharp rise in grocery spending.

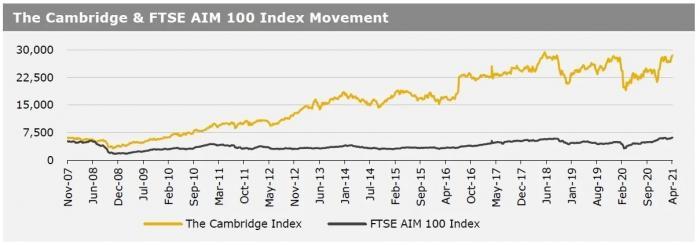

In major news, Bank of England chief economist, Andy Haldane, is set to leave the central bank later this year. The FTSE 100 index advanced 1.5% to settle at 7019.5, while the FTSE AIM 100 index rose 1.7% to close at 6194.2. Meanwhile, the FTSE techMARK 100 index gained 1.0% to end at 6794.2.

US markets ended higher in the previous week, following a string of positive US economic data and upbeat corporate reports. Adding to the positive sentiment, Federal Reserve Chairman Jerome Powell stated that the US economy is poised for a stronger growth, buoyed by rising vaccinations, business re-openings and fiscal support. On the macro front, US consumer price inflation increased to a two and a half year in March, driven by surge in gasoline prices while the producer price index advanced to its highest level since September 2011 in March. Moreover, initial jobless claims fell to its lowest level since March 2020 last week indicating signs of improvement in the labour market while retail sales climbed by the most in 10 months in March. Also, the nation’s housing starts surged to a 15-year high level in March, while building permits rose in March. The DJIA index rose 1.2% to end at 34200.7, while the NASDAQ index gained 1.1% to close at 14052.3.