Johnson Matthey, up 3.4%, announced significant strategic developments in the commercialisation of eLNO, its portfolio of leading nickel rich advanced cathode materials, which puts the company at the forefront of providing a sustainable and secure supply of cathode materials for customers.

Frontier Developments, up 0.8%, announced that Elite Dangerous: Odyssey, the highly anticipated new era for Elite Dangerous game, would be released on 19 May for Windows PC through Steam, the Epic Games Store and FrontierStore.net.

Checkit, up 14.9%, announced a new self-installation feature for automated temperature monitoring in the food industry.

Sareum, up 10.3%, in its unaudited half-yearly results for the six months ended 31 December 2020, announced that it reported nil revenue during the period. Loss before tax narrowed to £0.61m from £0.69m recorded in the same period previous year. The Directors do not intend to propose any dividend in respect of the six months ended 31 December 2020.

Tristel, up 5.2%, announced that following the exercise of options by certain employees, it has issued and allotted 45,500 new ordinary shares of 1p each in the company. Separately, today the company, in its trading update, announced that, due to the impact of COVID-19 on patient examinations, its second half sales in all markets began gradually.

Kier Group, down 3%, in its interim results, announced that group revenues dropped to £1,617.1m from £1,819.2m recorded in the same period a year ago. No interim or final dividends have been declared during the period (six months ended 31 December 2019: £nil, year ended 30 June 2020: £nil).

Bango, down 5.3%, announced today that it has published the notice of the 2021 Annual General Meeting (AGM) and the Annual Report on the Bango website. The AGM will be held at 14:00 on 26 May 2021 at Clayton Hotel, 27-29 Station Road, Cambridge, CB1 2FB.

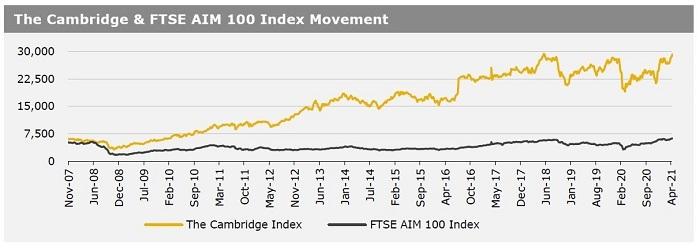

UK markets ended mostly lower last week, amid fears that surging coronavirus cases around the globe could slow economic growth. On the data front, Britain’s unemployment unexpectedly fell for a second consecutive month in the three months to February, helped by the government’s furlough programme, while the nation’s inflation accelerated in March, driven by rise in prices of clothing and oil. Additionally, house prices climbed at its fastest pace since 2014 in February, amid low mortgage rates and stamp duty holiday, while retail sales jumped in March, as easing of coronavirus lockdown restrictions lifted consumer spending. Moreover, UK’s services and manufacturing activity gained momentum in April. The FTSE 100 index dropped 1.2% to settle at 6938.6, while the FTSE techMARK 100 index lost 0.6% to end at 6754. Meanwhile, the FTSE AIM 100 index rose 1.3% to close at 6273.5.

US markets ended lower in the previous week, amid concerns over rising Covid-19 infections and amid reports that US President Joe Biden is planning to double capital gains tax. On the macro front, US weekly jobless claims dropped to a 13-month low in the week ended 16 April 2021, indicating signs of recovery in the labour market, whereas existing home sales fell to a seven-month low in March, due to shortage of properties, higher home and rising mortgage rates. Moreover, the nation’s manufacturing and services activity picked up in April, while new home sales climbed more than expected in March.

Additionally, the nation’s leading economic index jumped much more than expected in March, while the Chicago Fed National Activity Index rebounded in March. The DJIA index fell 0.5% to end at 34043.5, while the NASDAQ index lost 0.3% to close at 14016.8.