DS Smith, up 10.6%, launched its new sustainability vision and strategy “Now and Next”, which sets out the ambitious commitments and goals for the next decade.

Abcam lost 0.2%. The company announced that its Co-Founder and Non-Executive Deputy Chairman, Jonathan Milner, has stepped down from the Board.

Frontier Developments dropped 1.7%. The firm revealed “Forging Your Path”, the second in the series of its Elite Dangerous: Odyssey Developer Diaries.

Xaar, up 43.7%, in its interim results for the six months ended 30 June 2020, announced that its revenue dropped to £23.73m, from £25.47m recorded in the same period of the previous year. Loss before tax narrowed to £1.13m, from £2.95m.

1Spatial, up 1.6%, in its interim results for the six months ended 31 July 2020, announced that its revenue increased to £11.73m from £10.86m recorded in the same period last year. Loss before tax came in at £0.86m, compared to £0.67m.

Quixant, down 7.4%, announced that its subsidiary, Densitron, has entered into a new long-term technology partnership with specialist cameras and accessories manufacturer, Polecam. Separately, the company, in its unaudited interim results for the six months ended 30 June 2020, stated that its revenues stood at $27.90m, compared to $41.94m recorded in the same period last year.

Netcall, down 6.3%, announced that its audited results for the year ended 30 June 2020 will be released on 13 October 2020.

Cambridge Cognition, down 4.7%, announced today that Chief Executive Officer, Matthew Stork and Chief Financial Officer (CFO), Nick Walters, will conduct a live investor presentation on 14 October.

Dialight, down 3.1%, announced that Wai Kuen Chiang joined the Group as the Group's CFO on 1 October 2020.

CyanConnode, down 1.8%, announced that at its Annual General Meeting held on 30 September 2020, all resolutions were duly passed.

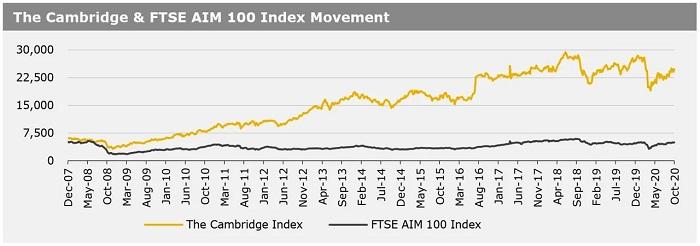

UK markets ended higher last week, as investors recovered from the initial shock of the US President, Donald Trump, testing COVID-19 positive. On the data front, the UK gross domestic product (GDP) slightly improved in 2Q 2020. Further, British factory activity grew for the fourth month in a row in September. UK house prices jumped at the fastest rate since 2016 in September, driven by pent-up demand and stamp duty holiday. In contrast, UK consumer credit came in less than expected for August. Separately, the European Union launched a legal case against the UK for undercutting their earlier divorce deal. The FTSE 100 index rose 1.0% to settle at 5902.1, while the FTSE AIM 100 index advanced 1.2% to close at 4931.6. Further, the FTSE techMARK 100 index gained 0.5% to end at 5666.9.

US markets ended higher in the previous week. However, gains were capped, as investors reacted to a weaker than expected September jobs report and amid news that the US President, Donald Trump and First Lady, Melania Trump have tested positive for the coronavirus. The US economy added fewer than expected jobs in September, recording the slowest increase since the recovery began in May 2020. Further, the ISM manufacturing PMI unexpectedly dropped in September. In other economic news, the US annualised GDP registered a slightly improved reading for 2Q 2020. Private sector employment jumped more than expected in September, while the nation’s pending home sales spiked in August. Further, US consumer confidence rebounded in September. The DJIA index advanced 1.9% to end at 27682.8, while the NASDAQ index rose 1.5% to close at 11075.