DS Smith, up 2.3%, announced that its subsidiary Monmouth Scientific Limited has acquired the business and certain net assets of Uniform Engineering for a cash consideration of £350,000.

Frontier Developments, up 0.8%, announced that revenues climbed to £36.91m from £31.97m recorded in the corresponding period of the previous year.

Checkit, up 14.3%, announced that it has acquired US based Tutela Monitoring Systems LLC for a cash consideration of $0.85m.

Oracle Power, up 12.7%, announced that the company and its consortium partner, China National Coal Development Company, have jointly submitted a policy proposal for coal-to-gas and coal-to-liquid development to the Pakistan’s Ministry of Energy.

Marshall Motor, up 8.3%, announced that it has opened two new franchised car dealerships, Seat and Cupra, in Oxford.

Netcall, up 5.3%, announced that the group has traded well in line with expectations during the first half period of FY21.

Sareum, up 2.7%, announced that its CEO, Dr Tim Mitchell, will digitally deliver a company presentation at the 7th Annual LSX World Congress, between 1 and 5 February 2021.

Amino Technologies, up 2.3%, announced that board will conduct a live presentation relating to the full year 2020 results via Investor Meet company platform on 10 February.

Kier Group, up 1.6%, announced that its Chairman Matthew Lester, would join the Intermediate Capital Group Plc as a Non-Executive Director.

Gaming Realms, down 3.4%, announced that its platform and portfolio has been certified for entry into the Italian gaming market by L'Amministrazione Autonoma dei Monopoli di Stato (AAMS).

1Spatial, which remained unchanged at 28p, announced today that, in partnership with Esri UK, it has entered into a two-year contract with Northern Gas Networks (NGN) to provide the UK's first enterprise migration to Esri's new ArcGIS Utility Network model.

UK markets ended higher last week, as the Bank of England (BoE) predicted a rapid rebound in the UK economy. On the data front, Britain’s manufacturing activity slowed to a three-month low in January, owing to further Covid-19 restrictions, while the services PMI contracted at its fastest pace since May 2020 in January, driven by business closures. Also, UK house prices dropped for the first time in seven months in January, amid decline in demand for properties, while the construction sector activity dropped for the first time in eight months in January. Also, the Halifax house prices fell for the first time in six months in January.

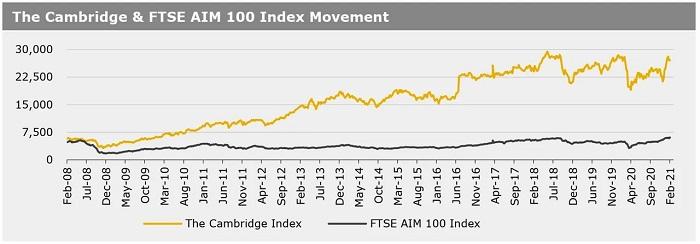

Meanwhile, the BoE, in its latest policy meeting, kept its interest rate steady at 0.10% and maintained its QE programme at £895b. However, the central bank indicated that it would introduce negative interest rates if the recovery falters. Further, the BoE forecasted that Britain’s economy would contract by 4% in the first three months of 2021 and also lowered its full year growth forecast to 5% from 7.25%. The FTSE 100 index advanced 1.3% to settle at 6489.3, while the FTSE AIM 100 index rose 4.7% to close at 6107.7. The FTSE techMARK 100 index gained 2.2% to end at 6402.

US markets ended higher in the previous week, on stimulus hopes, progress in vaccine rollout and robust earnings reports. On the macro front, the US services sector activity unexpectedly rose to a two-year high in January, while factory orders rose for an eighth straight month in December. Moreover, the nation’s private sector employment rose more than expected in January, while the US weekly jobless claims fell to a two-month low in the week ended 29 January 2021, boosting optimism over US economic outlook. On the flipside, the US ISM manufacturing PMI dropped more than expected in January whereas nonfarm payrolls rebounded less than expected in January. The DJIA index rose 3.9% to end at 31148.2, while the NASDAQ index climbed 6% to close at 13856.3.