AVEVA Group, up 4.1%, announced the launch of a new integrated cloud-based application called AVEVA Teamwork, built specifically for industrial workers to facilitate continuous learning and improvement.

Johnson Matthey, down 7%, in its half year results for the six months ended 30th September 2020, announced that its revenue stood at £6.98b, up from £6.82b recorded in the same period of the previous year. Diluted earnings per share declined to 12.3p from 91.6p.

Sareum Holdings, up 20%, announced that its Annual General Meeting (AGM) will be held on 15 December 2020, at the company's registered office at Cambridge.

Netcall, up 3%, announced that it has extended its current long term incentive plan (LTIP) for certain Directors of the company.

1Spatial, down 3.7%, announced that, following a competitive audit tender process, it has appointed BDO LLP as the company's external auditor for the financial year ending 31 January 2021.

Oracle Power remained unchanged at 0.6p. The firm announced that it has acquired two highly prospective gold projects in Western Australia.

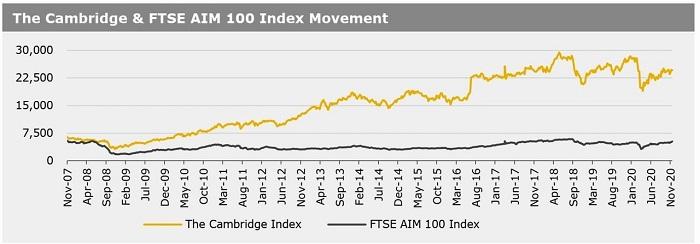

UK markets ended higher last week, boosted by optimism around a coronavirus vaccine and amid hopes of a Brexit trade deal with the European Union (EU). The EU’s Chief Executive, Ursula von der Leyen, stated that better progress towards a trade deal with Britain had been made during the last few days. However, there was still a lot of work to do for an agreement to be in place by the year-end deadline. On the data front, UK inflation edged higher in October, lifted by rising prices of clothing and footwear. British retail sales rose more-than-anticipated in October, underpinned by the online segment. In contrast, British consumer confidence sank to a six-month low in November, driven by a sharp deterioration of consumers’ outlook for their personal finances, amid a second lockdown to contain the spread of COVID-19. Further, British house prices declined on a monthly basis in November and government borrowing hit its highest level on record during October. The FTSE 100 index rose 0.6% to settle at 6351.5, while the FTSE AIM 100 index advanced 3.2% to close at 5233.1. Also, the FTSE techMARK 100 index gained 1.5% to end at 5935.8.

US markets ended mixed in the previous week, as rising COVID-19 cases raised concerns about the economic recovery, while being offset partly by progress toward COVID-19 vaccines. On the data front, the US October retail sales report recorded its weakest rise in six months, indicating that consumer spending is decelerating as the holiday shopping season approaches. Also, US weekly jobless claims unexpectedly rose last week. On the other hand, US industrial production rebounded higher-than-expected in October. US housing starts advanced in October, signalling that the nation’s housing market continues to be sustained by historically low mortgage rates, while existing home sales increased for a fifth straight month in October. Meanwhile, the US Federal Reserve (Fed) Chairman, Jerome Powell stated that the need for additional fiscal help from Washington was more pressing than it has been in a long time. Separately, the US Treasury Secretary, Steven Mnuchin, defended his decision to end several of the Fed’s pandemic lending programs on 31 December. The DJIA index fell 0.7% to end at 29263.5, while the NASDAQ index gained 0.2% to close at 11855.