DS Smith, down 3.1%, announced the proposed sale of its De Hoop paper mill in the Netherlands to De Jong Packaging for a cash consideration of €50 million.

Abcam, down 4.3%, announced that it has opened a new state-of-the-art facility in Boston, MA, to support the research and biopharma sector globally.

Science Group, up 2.5%, announced that three of its divisions have performed well during the first half of the year. Meanwhile, it expects its results for the six-month period ending 30 June 2021 to be released on 26 July 2021.

Xaar, up 0.3%, announced that it has completed the acquisition of FFEI Limited, based in Hemel Hempstead, UK, for £9.1m.

1Spatial, unchanged at 39.5p, announced that it has upgraded its 1Integrate, rules engine software to support 3D data in its data stores, rules and actions.

CyanConnode, unchanged at 10.8p, announced that it has received a further follow-on order for 31,000 Omnimesh Modules and associated gateways from its partner the JST Group for the Metropolitan Electricity Authority (MEA) project.

Netcall, unchanged at 71.5p, today, announced that it expects annual results to be in line with the board’s market expectations. The group expects to release its audited results for the year ended 30 June 2021 on 6 October 2021.

Oracle Power, down 15.8%, announced that over the past quarter activity has intensified at its two gold projects in Western Australia; Northern Zone and Jundee East.

Feedback, down 7%, announced that CVS Group (CVS) has selected Bleepa as its clinical communications app for its Equine Division.

Kier Group, down 6%, announced that the group’s trading continues to be resilient and hence, expects annual results to be moderately ahead of the Board's anticipations.

Checkit, down 3.5%, announced the appointment of Kit Kyte as Chief Executive Officer, with immediate effect.

Bango, down 1.1%, announced that revenue for the period jumped 49% to £7.1m from £4.8m in the same period last year. Cash balance stood at £7.1m as at 30 June 2021, up from £5.8m.

UK markets ended lower last week, amid persistent worries over rising inflation and surging cases of the Delta variant. On the data front, UK’s inflation accelerated at its fastest pace in three years in June, driven by rise in prices of food, second-hand cars, clothing and fuel, while British house prices climbed in May, as buyers rushed to take benefit of the government’s stamp duty holiday. Additionally, the nation’s payroll numbers rose for a seventh straight month in June, amid relaxation in lockdown restrictions, while retail sales climbed more than expected in June, as lifting of Covid restrictions buoyed consumer spending.

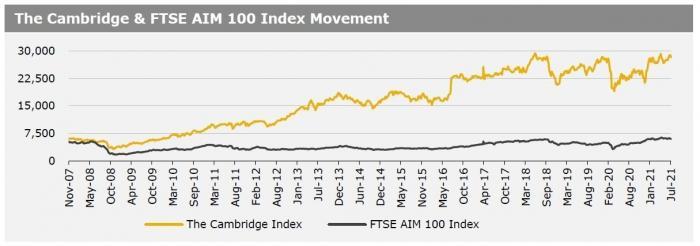

The FTSE 100 index declined 1.6% to settle at 7008.1, while the FTSE AIM 100 index fell 2.3% to close at 5983.2. Also, the FTSE techMARK 100 index lost 2.8% to end at 6727.

US markets ended lower in the previous week, amid growing concerns over inflation. On the macro front, the US consumer sentiment unexpectedly fell in July, on inflation worries. On the flipside, the US consumer prices climbed at its fastest pace in nearly 13 years in June, on the back of higher used automobile costs and food and energy prices, while the initial jobless claims dropped to a 16-month low in the week ended 09 July 2021. Also, the nation’s retail sales unexpectedly rose in June, as demand for goods remained strong.

Separately, the US Federal Reserve’s (Fed) Beige Book indicated that the US economy grew at a ‘moderate to robust’ pace from late May to early July. Meanwhile, the Fed pledged to maintain its accommodative policy stance and reiterated that rise in inflation would be transitory. The DJIA index fell 0.5% to end at 34687.9, while the NASDAQ index lost 1.9% to close at 14427.2.