Abcam, down 0.5%, announced, in its interim results for the six months ended 31 December 2020, that revenues rose 6.7% to £147.5m from £138.2m recorded in the same period a year ago. However, profit before tax narrowed to £13.8m from £26m. On the outlook front, the board remains confident in its growth strategy and is committed towards building an increasingly strong and sustainable global business.

1Spatial, up 22.9%, announced the launch of 1Integrate v2.8.1, which enables users to assess the quality of data to ensure it meets defined specifications and is fit for purpose.

Marshall Motor Holdings, up 6.9%, announced, in its full year results for the year ended 31 December 2020, that revenues dropped to £2,154.4m from £2,276.1m recorded in the previous year. Profit before tax widened to £20.4m from £19.6m. The Board believes it would be inappropriate to recommend the payment of a final dividend for 2020. However, the management is confident in the Group's future prospects and success.

Kier Group, up 4.8%, announced that it has partnered with housing provider Optivo, to enhance Dom's Food Mission’s workspace.

Science Group, up 4.8%, announced, in its audited results for year ended 31 December 2020, that revenues rose to £73.7m from £57.2m recorded in the previous year. Profit before tax stood at £6.4m compared to a loss of £1.6m. The Board has recommended a dividend of 4p per share. With a strong balance sheet, the Board continues to cautiously explore both add-on acquisitions and larger opportunities to increase the scale of the group.

Dialight, up 2.6%, announced that it has won an approval for the National Lighting Bureau's (NLB) Trusted Warranty programme.

Cambridge Cognition Holdings, up 1.4%, announced that CEO Matthew Stork and CFO Michael Holton will hold a live investor presentation on 23 March at 6pm London time. This follows the anticipated release of the company's preliminary results for the year ended 31 December 2020 at 7am on 23 March 2021.

Oracle Power, unchanged at 0.6p, announced that the recent gravity survey conducted across the Jundee East Gold Project in Western Australia, has confirmed the presence of a newly identified substantial greenstone belt located directly adjacent and east of the Jundee Gold Mine.

UK markets ended higher last week, as easing of strict lockdown restrictions and speedy vaccination programmes buoyed prospects for a swift economic recovery. On the data front, UK’s gross domestic product contracted less than expected in January. Also, the nation’s trade deficit narrowed in January.

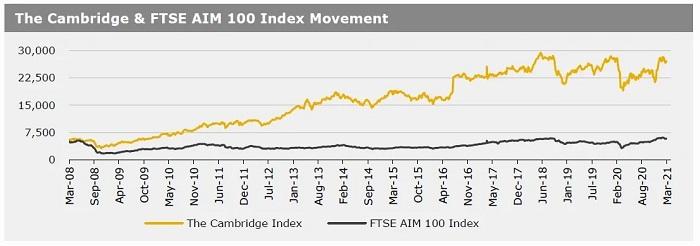

Meanwhile, both, industrial and manufacturing production declined more-than-expected in January. Separately, Bank of England Governor Andrew Bailey warned about a possible rise in inflation and stated that risks to UK economy remain tilted to the downside. Also, he cautioned that the unemployment is likely to rise and remain higher a year from now. The FTSE 100 index advanced 2.0% to settle at 6761.5, while the FTSE AIM 100 index rose 2.4% to close at 5878.7. Additionally, the FTSE techMARK 100 index gained 3.2% to end at 6458.5.

US markets ended firmer in the previous week, as US President Joe Biden signed the $1.9t stimulus bill into law. On the macro front, the US JOLTs job openings climbed to an almost one-year high level in January, while the nation’s initial jobless claims declined to a 4-month low in the week ended 5 March 2021, putting the labour market recovery back on track. Additionally, consumer prices climbed in line with market expectations in February, driven by rise in gasoline prices, while the nation’s small business optimism index improved in February. Also, the Michigan consumer sentiment index jumped to a one-year high level in March. The DJIA index rose 4.1% to end at 32778.6, while the NASDAQ index gained 3.1% to close at 13319.9.