Abcam, up 0.4%, announced that Lady Louise Patten has retired from her roles as Non-Executive Director, Senior Independent Director and chair of the Remuneration Committee.

Science Group, up 10.1%, in its trading update, announced that all of its three divisions achieved strong progress in the year. Cash balance stood at £29.5m as at 30 April 2021 with net funds of £13.3m.

Marshall Motor, up 5%, in its trading statement, announced that trading in the initial months of the financial year was impacted by the closure of its physical retail businesses from 5 January 2021 until 12 April 2021. However, it continued to operate effectively on a 'click and collect' basis. The group would release its interim results for the six months ending 30 June 2021 on 10 August 2021.

1Spatial, up 1.2%, announced that it has been awarded a UK Patent for Modification and Validation of its data.

Quartix, unchanged at 485p, announced that Emily Rees has been promoted to Chief Financial Officer and Executive Director, with immediate effect. Additionally, in its trading update, announced that the group witnessed good progress in 2021, with trading for the four-month period to 30 April 2021, being consistent with meeting market expectations.

Bango, down 3%, announced that it would be holding an in-person Strategy Day for investors and analysts at 13.15 BST on 8 July 2021 at The Loading Bay, Techspace, 25 Luke Street, London, EC2A 4DS.

CyanConnode, unchanged at 7.3p, announced that it has entered into a Global Strategic Alliance Agreement with SEW (Smart Energy Water).

Dialight, unchanged at 312p, announced that current trading performance was in line with the board expectations and outlook for the year remained unchanged. Further, it expects to release its interim results in early August 2021.

UK markets ended mostly higher last week, as Britain began its second phase of reopening and following a series of positive economic data. On the data front, British consumer prices more than doubled in April, driven by rise in oil prices and gas and electricity bills, while the nation’s house price inflation accelerated to its highest level in 14 years in March. Additionally, the unemployment rate dropped in the three months to March, as firms began to hire again, while easing of lockdown curbs lifted UK’s consumer confidence to pre-pandemic level.

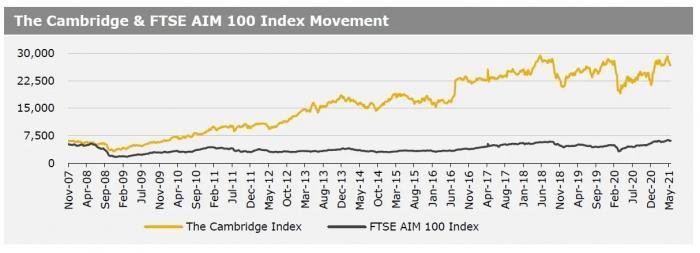

Britain’s retail sales surged in April, as non-essential shops reopened from virus lockdown, while the nation’s manufacturing PMI expanded at its fastest pace since 1992 in May. The FTSE techMARK 100 index climbed 1.2% to end at 6575, while the FTSE AIM 100 index rose 1.5% to close at 6166.5. Meanwhile, the FTSE 100 index declined 0.4% to settle at 7018.1.

US markets ended mixed in the previous week, as the US Federal Reserve’s taper talks overshadowed optimism over US reopening. On the macro front, the US building permits climbed in April, whereas the nation’s housing starts fell more-than-expected in April, amid high prices for building materials. Further, US weekly jobless claims dropped to its lowest level since mid-March 2020 in the week ended 14 May 2021, signalling recovery in the labour market. Moreover, the US manufacturing PMI unexpectedly rose in May.

On the other hand, the Philadelphia Fed manufacturing declined more than expected in May, while US existing home sales dropped for a third straight month in April. In major news, the FOMC minutes revealed that policymakers were cautiously optimistic about the US economic recovery and indicated that the central bank might reconsider scaling back asset purchases in upcoming meetings, if the US economy continues to make “rapid progress” toward the Committee’s goals. The DJIA index fell 0.5% to end at 34207.8, while the NASDAQ index gained 0.3% to close at 13471.