Johnson Matthey, up 4.7%, announced that it has entered into a joint development agreement with Nano One.

Abcam, down 3.5%, announced that it has now officially changed its accounting reference date and financial year end from 30 June to 31 December. Moreover, its General Meeting would be held on 1 July 2021 at 2pm at the company's registered office at Discovery Drive, Cambridge Biomedical Campus, Cambridge, CB2 0AX.

Frontier Developments, up 4.7%, announced that its games label, Frontier Foundry unveiled a new game Warhammer 40,000®: Chaos Gate - Daemonhunters in partnership with Warhammer 40,000 creator Games Workshop®. Meanwhile, the company announced that it would release its full year trading update on 11 June 2021.

CyanConnode, up 45.6%, announced that it has successfully raised £3.15m through the placing of 27,196,395 new ordinary shares at a price of 9.5p per share.

Sareum, up 27.9%, announced that it has raised proceeds of £900,000, via subscription by a high net worth individual for 32,142,855 new ordinary shares of 0.025p each at a price of 2.8p per share. The net proceeds from the transaction would be used to progress the company's SDC-1801 TYK2/JAK1 inhibitor drug development programmes as well as for working capital purposes.

Cambridge Cognition, up 9.5%, announced that it has appointed Michael Holton as Executive Director, with immediate effect.

Xaar, up 6.5%, announced that it has partnered with the Beijing National Innovation Institute of Lightweight Ltd. (BNI) to develop a Joint Digital Printing Laboratory.

Checkit, unchanged at 63.5p, today announced that it has appointed Simon Greenman as Non-Executive Director with immediate effect. Also, Simon would join the Remuneration and Audit Committees of the Board on 1 July 2021.

UK markets ended mostly lower last week, amid fears that UK could push back the 21 June reopening due to the Indian Covid-19 variant. On the data front, UK house prices rose at their fastest pace since 2014 in May, driven by an increase in demand for new homes and a temporary stamp duty holiday, while the nation’s construction sector expanded for the fourth straight month in May, amid a record jump in new orders as coronavirus lockdown measures eased.

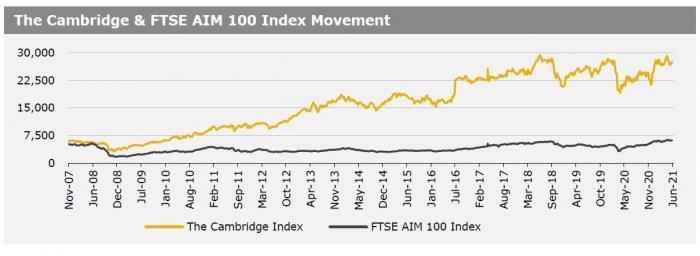

Additionally, the UK’s manufacturing PMI rose to a 30-year high level in May, while services PMI jumped to a 24-year high level in May, as pubs and restaurants resumed services. In contrast. the BRC shop prices fell for a second consecutive month in May. The FTSE techMARK 100 index lost 0.3% to end at 6737.3, while the FTSE AIM 100 index fell 0.3% to close at 6169.2. Meanwhile, the FTSE 100 index advanced 0.7% to settle at 7069.

US markets ended higher in the previous week, amid signs of recovery in the US labour market. On the macro front, the US ISM manufacturing activity expanded in May, despite supply chain problems, while the nation’s services sector activity gained momentum in May, as businesses reopened. Additionally, the US private sector employment spiked in May, after companies hired large number of employees, while weekly jobless claims fell for a fifth consecutive week in the week ended 28 May 2021, pointing to strengthening labour market conditions. Also, the US unemployment rate dropped more than expected in May, as the easing pandemic boosted more hiring in the country.

However, US nonfarm payrolls rose less than market expectations in May. Separately, the Federal Reserve’s Beige Book report indicated that the US economy expanded at a moderate pace from early April to late May, supported by increased vaccinations and easing coronavirus restrictions. The DJIA index rose 0.7% to end at 34756.4, while the NASDAQ index gained 0.5% to close at 13814.5.