Sareum, up 10.4%, announced that it has raised £1 million through a subscription for 14,285,714 new ordinary shares of 0.025p each at a price of 7.0p per share.

Xaar, up 8.9%, in its trading update for the six months ended 30 June 2021, announced that its trading performance was in line with the group’s expectations.

SDI Group, up 4.5%, in its final audited results for the year ended 30 April 2021, announced that revenues rose to £35.1m from £24.5m recorded in the previous year. The Board decided not to pay a dividend this financial year but would review again in 2022.

Science Group, up 2.4%, announced that its subsidiary, Frontier Smart Technologies has reached an agreement with Imagination Technologies Limited to settle all future royalties associated with the use of the licensed technology in consumer electronics for a single amount payment of $6m. Separately, today, the firm, in its interim results for the six months ended 30 June 2021, announced that revenues rose to £40.66m from £36.90m recorded in the same period previous year.

IQGeo Group, up 2.1%, in its trading update, announced that it expects to report robust performance for the six months ending 30 June 2021 and in line with expectations. Additionally, the board expects its revenue for the period to be around £6m (1H 2020: £4.7m). LPA Group, up 0.7%, announced that Director and Chairman, Peter G Pollock would retire from the board, with effect from 8 August 2021.

Tristel, down 1.5%, in its trading update for the year ended 30 June 2021, announced that growth in sales activity, combined with a gross margin maintained at 80% and tight control over operating costs, would result into sales of £31m (2020: £31.7m) and pre-tax profit of £5.5m (2020: £7.1m) for the year. The Board has pledged to declare a final dividend of 3.93p, making a total of 6.55p for the year.

Quartix Technologies, down 0.2%, announced the appointment of Richard Lilwall as Chief Executive Officer (CEO) and as board member. He would replace co-founder, Managing Director and CEO, Andy Walters, who is set to retire following 20 years of service.

Netcall, unchanged at 71.5p, in its trading statement, announced that it expects its annual results to be in line with market expectations, with revenue growth of approximately 8% to £27.2m (FY20: £25.1m). Further, the board expects to release its audited results for the year ended 30 June 2021 on 6 October 2021.

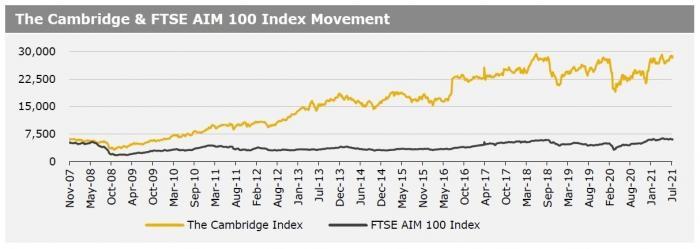

UK markets ended higher last week, amid weakness in the British Pound. On the data front, UK’s consumer confidence index rose for a sixth straight month in July, while the nation’s retail sales rebounded in June, registering its biggest monthly rise since March 2020, as the start of the Euro 2020 football tournament buoyed food store sales. Additionally, Britain’s public borrowing dropped in June, amid easing lockdown measures. Meanwhile, UK’s business activity slowed to a four-month low in July, due to shortages of staff and materials. The FTSE 100 index advanced 0.3% to settle at 7027.6, while the FTSE AIM 100 index rose 1.7% to close at 6083.1. Also, the FTSE techMARK 100 index gained 3.7% to end at 6974.5.

US markets ended higher in the previous week, as upbeat US corporate earnings reports renewed optimism over economic recovery. On the macro front, existing home sales climbed for the first time in five months in June, indicating a modest improvement in supply, while homebuilding increased more than expected in June. Meanwhile, US weekly jobless claims unexpectedly rose to a 2-month high in the week ended 16 July 2021, despite improvement in labour markets, while the nation’s building permits fell to an eight-month low in June. The DJIA index rose 1.1% to end at 35061.6, while the NASDAQ index gained 2.8% to close at 14837.