Dr David Gillett will lead the management team with the expertise of the founders retained on the executive board. Professional advice on this buyout was led by PEM Corporate Finance.

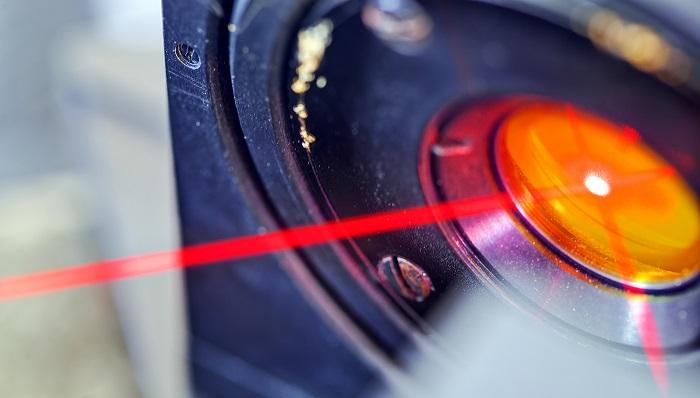

Since 1992, Laser 2000 has developed close relationships with the best photonics, optics, telecoms and network product manufacturers around the world. Driven by in-depth knowledge of optics and photonics, the company has been actively involved in the application of many world-changing technologies with its customers delivering projects such as the roll-out of fibre optic broadband, protection of the natural environment and furthering understanding of the human genome. The company, which also has an operation in the United States, serves customers across a wide range of sectors, including, Life Sciences, Telecoms, Aerospace and Defence, Energy, Healthcare, and Education.

The incumbent senior leadership team of Alan Hughes, Geoff Mudge and Guy Holmes are joined by Dr David Gillett as Group Managing Director and Nick Tiley as Group Finance Director on the executive board, and a number of other employees also became shareholders. David is an experienced business leader with a strong high tech and manufacturing background, and Nick a veteran Finance Director with a scientific instruments and engineering background.

Guy Holmes, the new Chairman of Laser 2000 commented on what the succession strategy meant for the company: “We’ve come a long way from the original MBO in 2008 and I’m delighted to have broadened the ownership of the company and to have secured succession with such a strong team to take the company forward. I’d like to thank the team at PEM Corporate Finance for their insight and tenacity and for guiding us all the way from an early strategic planning session to where we are today.”

Group Managing Director, Dr David Gillett said, “This buyout is the first step in enabling employee share ownership to give staff a stake in the successful culture they help to create. I’m delighted to be leading the business into its next phase of growth as we seize opportunities to grow into adjacent strong sectors in the UK and USA. We will continue the strong balance sheet approach that the founders have nurtured, and which is one of our key success factors.”

PEM Corporate Finance were appointed by the founding shareholders to oversee the succession buyout process.

Lake Falconer, Partner at PEM Corporate Finance added, “Laser 2000 is a great example of a knowledge-led business and its growth has been underpinned by its people’s deep product knowledge allied to a very strong service ethic. The directors nurtured this special culture at Laser 2000 and we’re delighted to have helped them deliver a succession buyout which sets the company up to continue its growth trajectory”.

Legal advice for this success process was provided by Mike Matthews and Joanne Sinclair of Roythornes Solicitors and Andrew Cooper of Greene & Greene Solicitors. Funding was provided by Santander’s Growth Capital team.