On the day it was announced that UK GDP fell 2%, 10to8 is using its unique, anonymised data, to see the detail behind this. How badly some sectors have been hit and where businesses are proving resilient. Some highlights from their first analysis are below. As countries ease lockdown restrictions 10to8 will be releasing more information to help businesses manage their new normal.

The fastest to transition to virtual appointments was higher education. Bookings that were previously in a physical location moved online within two weeks. During that time, there were almost no cancellations and no drop off in the number of bookings. This is a sector usually seen as more conservative, so for it to outperform medical, banking, and tutoring areas was a surprise to the 10to8 team.

The US is outperforming the UK in terms of booking provisions. In the US, 10to8 has seen less dramatic drops in bookings than in the UK and US businesses have been faster to recover. This has an accumulating effect: UK service-based businesses are now 25% less busy than their comparable US cousins.

The UK’s beauty sector has been surprisingly innovative with many businesses transitioning quickly to new services online such as haircut and nail tutorials being provided online through virtual sessions.

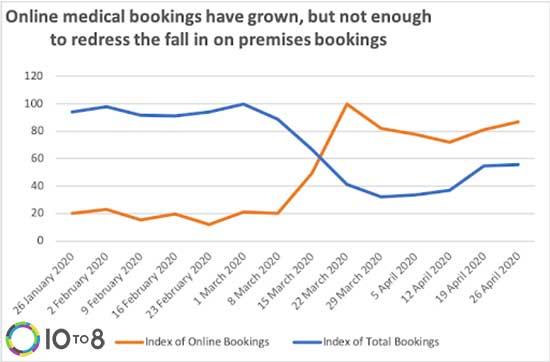

The medical sector has been moving online at a concerningly slow rate. The medical sector has been slowest to adapt to lockdown. Over 60% of regular medical appointments did not take place at peak lockdown. This is a far worse figure than most other comparable industries where bookings are possible to be conducted in a virtual space.