Cambridge GaN Devices (CGD), the fabless semiconductor company spun out of the renowned power device group at the University of Cambridge’s Engineering Department in 2016, has raised $19 million in Series B funding to accelerate mass production of its range of GaN transistors.

The investment was led by Parkwalk Advisors and BGF, with support from IQ Capital, CIC, Foresight Williams Technology and Martlet Capital.

Dr Giorgia Longobardi, co-founder and CEO of CGD, said: “CGD is poised to become one of the leaders in enabling a sustainable world. As we move to a net-zero carbon society with rapidly increasing levels of electrification, we need clean, renewable sources of electricity and more efficient conversion methods. GaN provides the optimum conversion solution, reducing power losses by more than 50% and increasing energy conversion efficiency to above 99%. To take just one application example, if all data centres were to adopt GaN, this would save 12.4TWh of electricity per year, or 9 million tons of CO2 - the equivalent of taking 1.9 million internal combustion engine vehicles off the road for a year *. Our ICeGaN™ GaN transistors – which are now in the hands of customers at scale – are amongst the most efficient devices of their type on the market. Our devices are also the easiest for designers to use.”

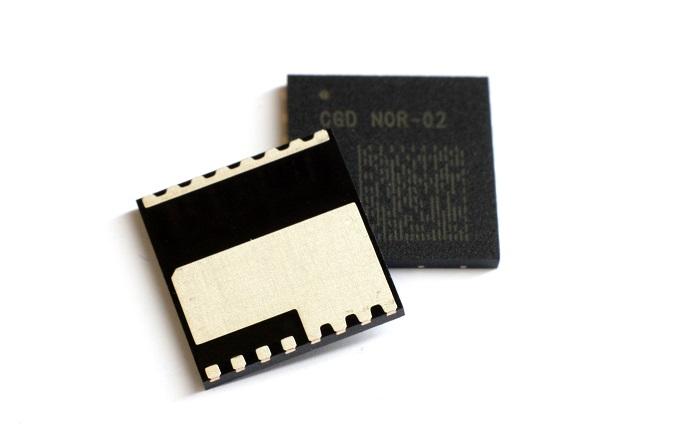

CGD has already made significant progress developing new intellectual property and launching its new ICeGaN™ Gallium Nitride transistor family to address the $50 billion global power semiconductor market. The company is uniquely positioned to disrupt multiple industries such as consumer and industrial power supplies, lighting, data centres, and automotive Hybrid-Electric and pure-Electric vehicles. CGD’s innovative and easy-to-use technology provides efficient, sustainable, and more cost-effective power solutions for electronic equipment.

CGD is currently leading a $10 million European-funded project developing GaN-based modules for low and high-power applications (GaNext); is participating in a UK supply chain initiative for PCB-embedded power systems with GaN devices (P3EP), and recently launched a project to develop highly reliable GaN power transistors and ICs to cut data centre emissions (ICeData). CGD is also focused on key partnerships with their customers focused at the datacom and automotive solutions.

The company has completed its brand development, moved to new offices, and now employs over 40 staff worldwide, with more planned to support the company’s growth. The funding will enable CGD to deliver mass production of its its GaN transistors for power applications.

Dr Longobardi added: “This latest round of investment is a great recognition of our success to date, with new and existing investors confirming the strength of our technology. Since 2016, CGD has been on a mission to make greener electronics possible and to shape the future of power electronics by delivering the most efficient and easy-to-use transistors. We are thrilled to be in a position to move to mass production and global supply, delivering devices where our unique technology can have the biggest impact.”

Dennis Atkinson, investor at BGF, commented: “CGD has the power to help society significantly reduce its reliance on old fossil fuel burning technologies and move towards new energy-efficient solutions. Climate tech is at the heart of BGF’s growth strategy, and we’re excited to be providing further investment to CGD which will enable the business to deliver widespread production of its GaN transistor family and contribute to the global sustainability movement.”

John Pearson, investor at Parkwalk Advisors, said: “CGD's technology can play a significant role in the global shift to net zero and it is already making an impact in real world applications. Parkwalk is delighted to be able to continue supporting the company and its impressive and growing team. We look forward to seeing the next phase in CGD's exciting growth journey.”