Johnson Matthey, up 4.3%, announced that the first tranche of up to £100m of a share buyback programme announced on 24 November would commence from 21 December 2021 and would end no later than 8th March 2022, provided that the Programme may be extended for up to 10 further trading days if necessary to account for disruption events during the initial term of the Programme.

Science Group (former Sagentia Group), up 1.8%, announced that it has negotiated a new bank revolving credit facility (RCF) with Lloyds Bank Plc for up to £25m with an additional £5m accordion option, for a term of four years with a 1-year extension. The RCF is in addition to the Group's existing term loan which expires in 2026.

Marshall Motor Holdings, unchanged at 393p, announced that its accounting reference date has been changed from 31 December to 31 March. As a result, the next audited financial statements would be prepared in respect of the 15-month period ending 31 March 2022.

Oracle Power, down 1.1%, announced an update related to its strategy gold exploration projects in Western Australia. At Jundee East Gold Project, it has identified five priority targets from geochemical sampling which would guide drilling activities during this campaign. Meanwhile, at the Northern Zone, it expects assay results from the first phase of drilling to be received in late December or early January for internal processing and analysis. The board is optimistic about the potential for this project to deliver compelling results from work campaigns in 2022.

UK markets ended higher last week, as the British government indicated that it would not impose any new coronavirus restrictions until after Christmas, as two studies suggested that the Omicron variant was less severe compared to the Delta variant. On the data front, Britain’s economy grew at a slower pace in the third quarter of 2021, amid weaker consumer spending, while the nation’s public borrowing declined in November, as the British government’s furlough scheme ended.

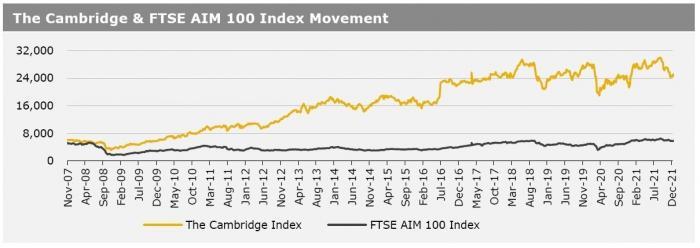

The FTSE 100 index rose 1.4% to settle at 7,372.1, while the FTSE AIM 100 index climbed 2.9% to close at 5,924.7. Meanwhile, the FTSE techMARK 100 index gained 2.9% to end at 6,917.6.

US markets ended firmer in the previous week, amid optimism that the new Omicron variant won’t derail global economic recovery. On the macro front, the US economy expanded more than initially estimated in the third quarter of 2021, driven by robust consumer spending while the nation’s consumer confidence index rose to its highest level since July in November. Moreover, durable goods orders jumped more than expected in November, amid significant increase in orders for transportation equipment. Additionally, the US existing home sales advanced for a third straight month in November, while the nation’s new home sales rose to a 7-month high in November. Also, both, personal income and personal spending climbed in November.

Furthermore, the US consumer sentiment improved in December, while the weekly jobless claims remained steady at a 50-year low in the week ended 17 December 2021. The DJIA index gained 1.7% to end at 35,950.6, while the NASDAQ index climbed 3.2% to close at 15,653.4.