Goldman Sachs increased its target price on AVEVA Group, up 7.5%, to 4100p from 3600p and gave a “Neutral” rating.

DS Smith, up 4.1%, announced the appointment of Geoff Drabble as Chairman Designate and a Non-Executive Director to the board with effect from 1 September 2020.

Johnson Matthey, up 2.1%, announced a contract with JSC Technoleasing to provide license for the 3,000 mtpd plant for the latter’s new Amur Oblast facility in Russia. Berenberg lifted its target price on the stock to 2700p from 2400p.

Abcam, up 3.8%, announced that Jonathan Milner, co-founder and Non-Executive Deputy Chairman will not stand for re-election at the next Annual General Meeting (AGM).

Frontier Developments, down 1.9%, announced that Planet Coaster, the ultimate coaster park simulation, will be released for next generation of consoles in Holiday 2020.

CyanConnode, up 32.8%, announced today that it has started shipment of Omnimesh RF Modules for the order declared in January 2020.

Bango, up 20.7%, announced that it has launched carrier billing payment option for SoftBank Corp. on Amazon.co.jp. Amazon customers with a SoftBank account will be able to make payments and charge the cost to their mobile phone bill.

Checkit, up 18.3%, announced that its annual revenues climbed to £9.8m from £1m, while its loss before tax widened to £16.4m from £4.5m.

Science Group, up 15.4%, announced that it expects operating profit for H12020 to be 50% higher than the last year, despite the challenges due to the Covid-19 pandemic. Separately, the company announced the appointment of Peter Bertram to the Board as Non-Executive Director with immediate effect.

Dialight, up 8.8%, announced that it expects trading performance for FY2020 to be weighted towards the second half.

1Spatial, down 5.7%, announced the resignation of Nicole Payne as Chief Financial Officer (CFO) and the appointment of Andrew Fabian as an Interim CFO, with immediate effect.

Feedback, down 11.4%, announced that it has conditionally raised $5.05m via placing of 505m new ordinary share at 1p per share. In addition, the company intends to provide all qualifying shareholders with the opportunity to subscribe up to 54m new ordinary shares to raise approximately £0.54m.

Marshall Motor, unchanged at 122.5p, announced that its AGM will be held on 16 July 2020.

GRC International Group, unchanged at 28.5p, announced today that its trading performance in the first quarter is ahead of plan, with billings ahead of management’s expectations.

LPA Group, down 1.4%, announced that its half-yearly revenues rose to £10.8m from £10.1m in the same period a year ago. Profit before tax stood at £0.18m, compared to a loss of £0.19m in the last year.

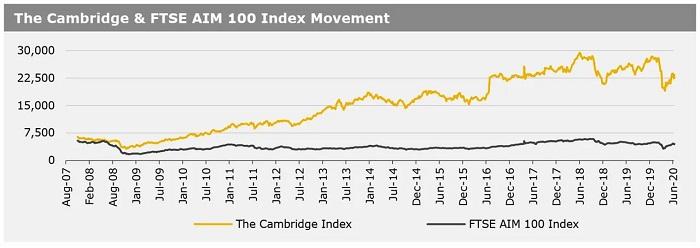

UK markets closed higher last week, lifted by gains in mining and healthcare sector stocks. On the data front, UK’s unemployment rate unexpectedly remained unchanged in the three months to April, while retail sales rose more than expected in May. On the contrary, British economy recorded its largest monthly contraction on record in April, whereas consumer prices dropped to a-year low in May. In major news, the Bank of England kept its interest rate unchanged, however increased its quantitative easing programme by £100 billion to support the economy from Covid-19 crisis. The FTSE 100 index advanced 3.1% to settle at 6292.6, while the FTSE AIM 100 index rose 3.1% to close at 4568.4. Moreover, the FTSE techMARK 100 index gained 4.6% to end at 5472.6.

US markets ended higher in the previous week, as investors remained hopeful for an additional stimulus from the US government. In economic news, US retail sales surged more than expected in May, and building permits rose in the same month. Moreover, the US initial jobless claims fell in the last week. In other major news, the US Fed Chairman, Jerome Powell, stated that the US economy is facing a deep downturn, with significant uncertainty about the timing and strength of the recovery. The DJIA index rose 1% to end at 25871.5, while the NASDAQ index also gained 3.7% to close at 9946.1.