Credit Suisse reiterated its “Outperform” rating on AVEVA Group, down 3.1%, with a target price of 4500p.

Checkit, up 7.8%, in its trading update for the six months to 31 July 2020, stated that recurring revenues improved by 23%, boosted by new installations and the conversion of existing annual calibration and maintenance contracts in the healthcare sector.

Quixant, up 7%, announced that Chief Financial Officer (CFO), Guy Millward, will step down from the board and will leave the firm on 21 August 2020.

Gaming Realms, up 4.5%, announced that its Slingo Originals content is now live with the Jumpman Gaming platform.

Sareum Holdings, down 3.8%, in its pre-close trading statement, announced that it continues to advance its proprietary selective dual tyrosine kinase 2 (TYK2) / Janus kinase 1 (JAK1) inhibitors through preclinical development as potential once-daily, oral immunotherapy candidates.

Amino Technologies, down 6.6%, in its unaudited results for the six months ended 31 May 2020, announced that revenue rose to $38m from $34.6m recorded in the same period of the previous year. Its basic earnings per share declined to 0.92c from 2.94c in the previous year.

Horizon Discovery Group remained unchanged at 107p. The firm announced today, in its unaudited results for the six months ended 30 June 2020, that revenues declined to £22.4m from £26.1m in the same period last year. Its loss before tax widened to £11.3m from £5.2m.

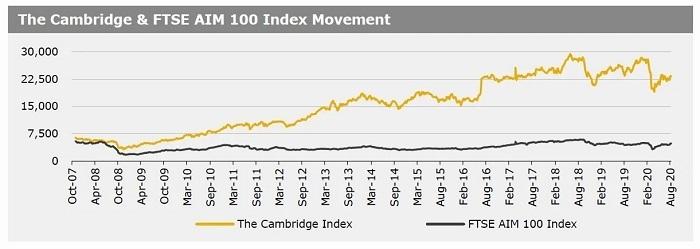

UK markets closed higher last week, as investors looked past the nation’s dire 2Q 2020 gross domestic product figures. On the data front, the British economy sank into the deepest recession on record in 2Q 2020, due to the near shutdown of the economy from late March, as the government sought to stem the spread of coronavirus. Meanwhile, British unemployment rate remained steady, while average earnings including bonus declined more than expected in June. Also, the nation’s industrial production improved more than anticipated and manufacturing production jumped in June. The FTSE 100 index advanced 1% to settle at 6090, while the FTSE AIM 100 index rose 1.6% to close at 4831.1. Additionally, the FTSE techMARK 100 index jumped 0.6% to end at 5766.3.

US markets ended higher in the previous week, supported by progress in the search for a COVID-19 vaccine and following the release of stronger-than-expected economic data. US consumer prices rose more than expected and producer prices rebounded in July, with the latter recording its largest increase since October 2018. Further, US JOLTS job openings unexpectedly climbed in June. Meanwhile, initial jobless claims last week dropped below one million for the first time since March 2020. Further, US import prices rose for the third straight month in July, marking the biggest three-month jump since 2011. On the flipside, the nation’s retail sales rose less than expected in July, as consumers cut back on purchases of motor vehicles. The DJIA index rose 1.8% to end at 27931, while the NASDAQ index gained 0.1% to close at 11019.3.