Quartix Holdings plunged 7.4%.

Frontier Developments, up 4.1%, announced that its ultimate zoo simulation called Planet Zoo has introduced an Aquatic Pack version and that it will be available from 8 December.

Johnson Matthey, up 3.7%, announced that it has secured a multiple licence win for China’s Ningxia Baofeng Energy Group’s latest project, to develop five of the largest single-train methanol plants in the world.

SDI Group, up 15.2%, announced that it has acquired Monmouth Scientific Limited. Total consideration, including earnout, is forecasted to be approximately £5.8m, net of cash acquired.

IQGeo Group, up 8.3%, announced that it has agreed to acquire OSPInsight International Inc. for a total consideration of up to $8.75m.

Tristel, up 5.6%, announced that it has secured the ‘AIM Growth Business of the Year Award’ at this year's 2020 AIM Awards.

Oracle Power, up 4.3%, announced that its Board and HH Private Office have together reached the agreement that they will not continue on the development of an iron ore project in Guinea and decided to jointly focus on additional opportunities within the natural resources sector in Africa.

Bango, up 2%, announced that it has inked a partnership deal with DocuBay, to distribute memberships for IN10's international global VOD platform.

Sareum, down 3.5%, announced that approximately £174,000 in grant funding has been received and approved from the UK Research & Innovation.

Horizon Discovery Group, down 2.4%, announced that it has allowed two commercial licences to Sanyou Biopharmaceuticals Co. Ltd, for the cGMP-compliant CHOSOURCE™ platform.

Feedback, down 2.3%, announced that its revolutionary medical imaging communications app, Bleepa, has been selected by Healthcare UK to join a virtual healthcare mission to India from 8-10 December 2020.

CyanConnode, down 2%, announced that it has agreed on a £400,000 unsecured loan from certain Directors for working capital. Separately, the company announced the appointment of Allan Baig as Group Chief Operating Officer (COO) and Ratna Garapati as COO of CyanConnode India, both non-Board appointments.

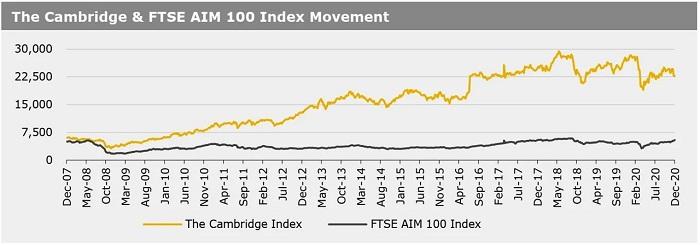

UK markets ended stronger last week, after UK approved the Pfizer-BioNTech COVID-19 vaccine. Further, Brexit talks remained in focus as the end of December deadline loomed. On the data front, the British manufacturing PMI advanced and construction order books rose at the fastest pace in over six years in November. Meanwhile, the British services sector in November suffered its first fall since June this year. The FTSE 100 index advanced 2.9% to settle at 6550.2, while the FTSE AIM 100 index rose 3.4% to close at 5444.1. The FTSE techMARK 100 index climbed 3.1% to end at 6168.5.

US markets ended higher in the previous week, amid optimism over progress towards COVID-19 vaccines and boosted by hopes for another financial aid package from the US Congress. On the data front, US factory goods orders rose for the sixth straight month in October. Meanwhile, nonfarm payrolls recorded the smallest monthly gain in November since the economy began to emerge from lockdown in the spring, while the unemployment rate dipped during the same month. Further, the services industry activity index slowed to a six-month low in November. The Federal Reserve’s (Fed) Beige Book report showed that officials saw little or no growth in four of their 12 regional districts and only modest growth in the others in recent weeks. The DJIA index rose 1% to end at 30218.3, while the NASDAQ index gained 2.1% to close at 12464.2.