AVEVA Group PLC, down 1.3%, announced in its trading update, that it has witnessed strong demand for AVEVA's software due to its ability to drive efficiency, flexibility and sustainability for customers across a wide range of industries.

Abcam, down 0.7%, announced that it has filed a registration statement on Form F-1 with the US SEC. Separately, the company announced that Co-Founder and Non-Executive Deputy Chairman, Jonathan Milner has stepped down from the board, effective immediately.

Netcall, up 21.6%, announced that it plans to release its audited results for the year ended 30 June 2020 on 13 October 2020.

Sareum, up 19.3%, announced that the United States Patent and Trademark Office has issued a notice of allowance for a patent in respect of an invention associated with Sareum's proprietary SDC-1802 TYK2/JAK1 Kinase Inhibitor Programme.

Cambridge Cognition, up 16.7%, announced that it has secured a new contract to provide cognitive tests and electronic clinical outcome assessments for an Alzheimer's trial. The contract is worth approximately £750,000 over two years and a considerable proportion of the revenue is expected to be received in 2021.

Gaming Realms, up 9.9%, announced that it has entered into a multi-year licensing contract with NetEnt.

Tristel, up 2.5%, announced that its preliminary results for the year ended 30 June 2020 will be released on 19 October 2020.

Xaar, up 0.8%, announced that it was subject to a cybersecurity incident that involved unauthorised access to its computer systems.

Science Group, down 0.4%, in its trading update, announced that the revenue progressed to stand higher of the board anticipation.

IQGeo Group, down 3.5%, announced the appointment of the Central Service Association as a new software reseller for its geospatial productivity and collaboration solutions.

Oracle Power, down 3.6%, in its Q3 2020 update, stated that discussions with the Private Power and Infrastructure Board for the Thar Block VI Project are progressing well. Further, the firm signed a financing facility for up to £46,500,000 the first aspect of which, delivered through a £1,500,000 share subscription deed, ensured that the company is funded for working capital costs for 2021. The second component, being up to £45,000,000 by way of a placing subscription facility, is available to Oracle over 60 months, subject to various conditions.

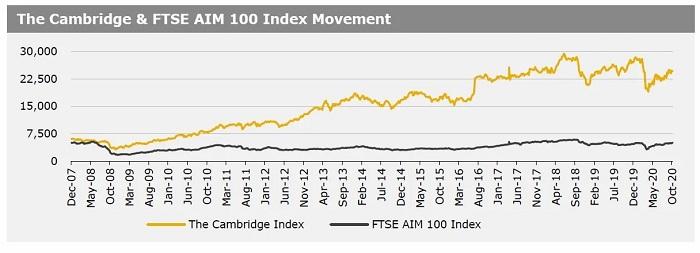

UK markets ended higher last week, after the Bank of England Governor, Andrew Bailey, stated that Britain and the European Union should be able to reach a trade deal. On the data front, the UK economy grew less than expected in August. Moreover, the British construction surprisingly picked up in September, lifted by a post-lockdown bounce in the housing market. The FTSE 100 index advanced 1.9% to settle at 6016.7, while the FTSE AIM 100 index rose 2.7% to close at 5065.5. Also, the FTSE techMARK 100 index climbed 4.1% to end at 5901.0.

US markets ended higher in the previous week, as comments by the US President, Donald Trump, reignited hopes of fresh fiscal support. On the macro front, the US service sector unexpectedly accelerated at a faster pace in September. Hiring and job openings in the private sector fell in August, in a sign that the US labour market was cooling off as an economic recovery lost some of its earlier momentum. Minutes of the Federal Reserve’s September policy meeting showed that senior Fed officials thought that the US economy was recovering faster than expected, but many had pencilled in another stimulus package before the end of this year. The DJIA index rose 3.3% to end at 28586.9, while the NASDAQ index jumped 4.6% to close at 11579.9.