Abcam, up 2.6%, announced that it has filed a transition report on Form 20-F for the six-month period from 1 July 2020 to 31 December 2020 with the US Securities and Exchange Commission in relation to its change of fiscal year-end from 30 June to 31 December. Further, the Group would release its interim results for the six- and 12-months ended 30 June 2021 on 13 September 2021.

Frontier Developments, down 0.2%, announced that it would release its full year results for the year ended 31 May 2021 on 8 September 2021.

Xaar, down 9.8%, announced that its half year results for the six months ended 30 June 2021 would be released at 7.00am (BST) on 14 September 2021.

Science Group, down 1.1%, announced the withdrawal of its indicative offer of 6.5p per share and confirmed that it would not make any further offer for TP Group. Today, the company, in its business update, announced that the group’s resilient performance provides it confidence for the remainder of the year. As at 31 August 2021, Science Group had gross cash of £17.2m. On the outlook front, the group raised its 2021 full year forecast for the second time this year.

Checkit, down 0.9%, today, announced that Chief Financial Officer, Aylsa Muir, has resigned from the Board to pursue other opportunities. Meanwhile, Greg Price, previously Director of Finance has been appointed as Chief Financial Officer (CFO), with immediate effect.

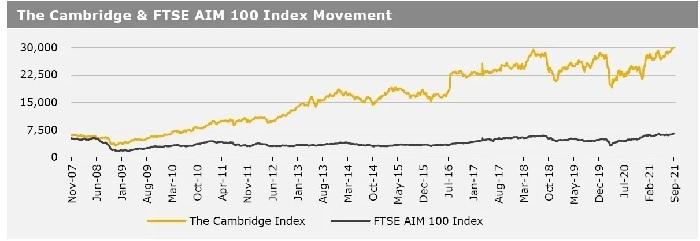

UK markets ended mostly higher last week. On the data front, Britain’s house prices accelerated to a 15-year high level in August, amid robust demand from those buying a property priced between £125,000 and £250,000. On the other hand, UK’s manufacturing PMI declined to a five-month low in August, amid supply chain issues while, the nation’s service PMI dropped in the same month. Additionally, the BRC shop prices fell in July. Moreover, the FTSE techMARK 100 index gained 0.5% to end at 7645.5, while the FTSE AIM 100 index rose 2.7% to close at 6547.3. Meanwhile, FTSE 100 index declined 0.1% to settle at 7138.4.

US markets ended mixed in the previous week, as weaker than expected US jobs data raised uncertainty about the timing of the US Federal Reserve’s (Fed) bond tapering plans. On the macro front, growth in nonfarm payrolls slowed more-than-expected in August, due to persistent labour shortages, while private sector employment climbed much less-than-expected in in the same month, denting the job market recovery. Moreover, the US pending home sales dropped for a second consecutive month in July, while the nation’s house prices fell in June.

On the flipside, the US ISM manufacturing declined in August, while factory orders rose in July. Additionally, the nation’s jobless claims dropped to its lowest level since March 2020 in the week ended 27 August 2021. The DJIA index fell 0.2% to end at 35369.1, while the NASDAQ index gained 1.5% to close at 15363.5.