DS Smith, down 0.1%, announced that it has continued its environmental education project with schools in Zărnești in partnership with the Brașov County School Inspectorate.

Johnson Matthey, down 4%, announced the sale of its health business to Altaris Capital Partners, for a total consideration of £325m.

Sareum, up 5.7%, announced that it has received ‘Intention to Grant’ notice from the European Patent Office for its SDC-1802 TYK2/JAK1 Kinase Inhibitor Programme.

Science Group, up 4%, announced that it has offered a revolving credit facility to TP Group Plc for up to £5m.

Feedback, up 1.9%, announced that it has entered into a partnership agreement with Amazon Web Services to establish and deliver cloud-based TB screening services to citizens in rural India.

GRC International Group, up 1.8%, in its interim results, announced that revenues rose to £6.63m from £5.41m recorded in the same period previous year.

Tristel, up 1%, in its AGM statement, announced that overall its geographical markets sales have picked-up, as hospitals have gradually returned to normal service levels.

Aferian, up 0.3%, in its trading update, announced that its trading performance was strong in line with board expectations.

Checkit, down 12.7%, announced that application has been made to the London Stock Exchange for the admission of 45,561,020 ordinary shares to trading on AIM.

Kier Group, down 7.3%, announced that it has handed over the £17.2m Creative Centre project to York St John University at its Lord Mayor's Walk campus in York City Centre.

Netcall, down 4.2%, in its AGM statement, announced that its trading performance was good and has continued with the same momentum in the first half of FY22.

Bango, down 3.1%, announced that it has signed a partnership agreement with Pray.com to expand its global customer base.

IQGeo Group, down 1.5%, announced that it has been awarded a 3-year contract worth more than $2.0m by major US electrical utility.

Cambridge Cognition, down 0.8%, announced that it has secured a contract worth over £500,000 to provide electronic clinical outcome assessments (eCOA) to support a major pharmaceutical client.

UK markets ended mostly lower last week, amid concerns over the Omicron variant. On the data front, UK’s services activity weakened to a 10-month low in December, as tight restrictions were imposed to contain the spread of the Omicron variant. Meanwhile, UK’s inflation climbed to a 10-year high in November, amid continued rise in prices of fuel and products, while the nation’s retail sales picked up in November, driven by Black Friday discounts as well as early Christmas shopping. Additionally, UK’s jobless rate dropped in the three months to end October, while house prices rebounded in October.

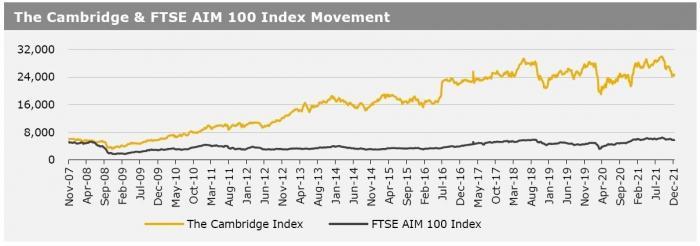

Separately, in a surprise move, the Bank of England raised its key interest rate from 0.10% to 0.25% to contain rising inflation. The FTSE 100 index declined 0.3% to settle at 7269.9, while the FTSE AIM 100 index fell 1.8% to close at 5755.7. Meanwhile, the FTSE techMARK 100 index gained 0.1% to end at 6720.6.

US markets ended lower in the previous week, amid concerns over rising inflation and a surge in Covid-19 cases. On the macro front, the US manufacturing PMI declined to a one-year low in December, amid supply chain disruptions, while the services PMI unexpectedly fell in December. Additionally, the US jobless claims climbed in the week ended 10 December 2021, while the nation’s retail sales rose less than expected in November.

On the flipside, the US housing starts accelerated to an 8-month high in November, while the nation’s building permits climbed in November. Meanwhile, the US Federal Reserve left its key interest rate unchanged at 0.25% and stated that it would end its pandemic-era asset purchases program. Moreover, the central bank signalled three interest rate hikes by the end of 2022. The DJIA index fell 1.7% to end at 35365.4, while the NASDAQ index lost 2.9% to close at 15169.7.