Sareum, down 22.3%, in its half-year results for the six months ended 31 December 2021, announced that it reported nil revenues during the period. The Directors do not propose the payment of a dividend in respect of the six months ended 31 December 2021.

Tristel, down 22.2%, in its interim results for the six months to 31 December 2021, announced that revenues dropped to £13.65m from £14.73m recorded in the same period previous year. The Board has proposed an interim dividend of 2.62p per share which will be paid on 29 April 2022.

Netcall, down 8.0%, in its interim results for the six months ended 31 December 2021, announced that revenues climbed to £14.69m from £13.35m recorded in the same period previous year. The board has approved a final dividend of 0.37p per share for the year ended 30 June 2021.

Aferian, down 2.4%, announced that its annual report and accounts for the financial year ended 30 November 2021 and notice of AGM have been posted to shareholders. The AGM would be held at the offices of Investec Bank Plc, 30 Gresham Street, London, EC2V 7QP on 21 March 2022 at 11.00 a.m. LPA Group, down 2.0%, announced the appointment of finnCap Ltd (finnCap) as its Nominated Adviser with immediate effect.

Bango, down 1.8%, announced that multi-play communications company, Entel has launched a new Apple Music bundled offer through the Bango Platform, initially in Chile.

Quartix Technologies, unchanged at 385.0p, today, in its results for the year ended 31 December 2021, announced that revenues slightly dropped to £25.51m from £25.84m recorded in the previous year. However, the Board has declared a final dividend of 7.00p per share.

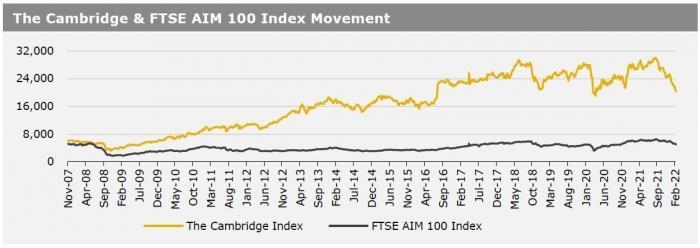

UK markets ended mostly lower last week, as Russia invaded Ukraine. On the data front, UK’s consumer confidence index dropped to a 13-month low in February, amid worries about the impact of surging inflation, higher taxes and interest rates. Meanwhile, UK’s manufacturing and services PMIs rebounded in February, amid easing of Omicron infections, while the nation’s house prices climbed in February, due to the relaxation of Covid-19 restrictions. Moreover, UK’s public sector net borrowing reported its first monthly surplus since January 2020, boosted by tax receipts. In a recent development, British Prime Minister, Boris Johnson stated that he would scrap all coronavirus restrictions in the country. The FTSE 100 index declined 0.3% to settle at 7,489.5, while the FTSE AIM 100 index fell 2.1% to close at 4,951.6. Meanwhile, the FTSE techMARK 100 index gained 1.4% to end at 6,239.0.

US markets ended mixed in the previous week. On the macro front, US gross domestic product grew more than initially estimated in 4Q 2021, while the nation’s weekly jobless claims declined in the week ended 18 February 2022, indicating signs of progress in the labour market recovery. Additionally, the US manufacturing and services activity gained momentum, as Covid-19 cases declined. Moreover, the US durable goods orders climbed more than expected in January. On the other hand, the nation’s consumer confidence index dropped to a five-month low month in February, amid worries over the country’s short-term economic outlook. Additionally, the US new home sales fell in January, weighed down by higher mortgage rates and material prices, while pending home sales dropped for a third straight month in January, amid record low inventory. Moreover, the Michigan consumer sentiment index fell in February, amid surging inflation. The DJIA index fell 0.1% to end at 34058.8, while the NASDAQ index gained 1.1% to close at 13694.6