Johnson Matthey, down 5.6%, announced that its results for the full year ended 31 March 2020 will be postponed by two weeks to 11 June 2020, amid a delay in completion of certain audit procedures.

Abcam, up 3.1%, announced that Mr Peter Allen would step down as the Chairman of the board of Diurnal Group on 30 June 2020, in accordance with the UK Corporate Governance Code (2018) and the view of certain shareholders that the Chairman cannot be a member of the Audit Committee. Further, the company stated that he will continue as a member of the audit and risk Committee, whereas his role as Chairman in nominations committee and member of the remuneration committee remain unchanged.

Bango, up 4.3%, announced that it has entered into a significant deal, worth £1.5m along with opportunity to earn additional revenues, with major global telecoms provider for an initial period of three years. Under the agreement, the major global telecoms provider will provide third party products and services to its customers through the Bango Platform.

Gaming Realms, up 0.3%, announced that it has entered into a two year agency agreement with Hasbro Inc, in which the latter will act as an agent on behalf of the group to negotiate licensing opportunities for its Slingo brand. The deal is expected to bring licensing opportunities to Gaming Realms in certain digital gaming categories outside the online real money gaming and lottery segments.

Science Group, down 2.4%, announced that its AGM will be held at the London office on 16 June 2020. Also, the company stated that it has not revised its expectations and it remains both profitable and cash generative. Moreover, the Group is planning for an interim dividend later in the financial year, if appropriate, instead of final dividend. Separately, the company announced the retirement of its Non-Executive Director, David Courtley, with effect from 31 May 2020, and it also plans to appoint Mr. Peter Bertram as a Non-Executive Director after the AGM this year.

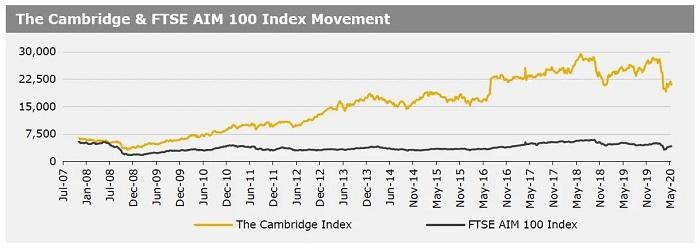

UK markets closed lower in the past week, amid growing concerns over second wave of coronavirus infections as government eases lockdown measures. On the data front, the UK economy recorded its biggest monthly decline since 1997 in March, whereas the nation’s industrial production slumped less than expected in March. On the flipside, the British BRC like-for-like retail sales unexpectedly rose in April, while the nation’s manufacturing production dropped less than expected in March. The FTSE 100 index declined 2.3% to settle at 5799.8, while the FTSE AIM 100 index fell 0.9% to close at 4134.2. Meanwhile, the FTSE techMARK 100 index lost 1.7% to end at 4996.6.

US markets ended weaker in the previous week, after the US Federal Reserve Chairman, Jerome Powell, warned that the coronavirus crisis could result in a prolonged recession and weak recovery. In the economic news, the US consumer price recorded its biggest monthly decline since December 2008 in April, while the producer price index recorded its largest decrease since 2009 in the same month. On the contrary, the US Michigan consumer sentiment index unexpectedly rose in May, while the weekly jobless claims fell less than expected in the last week. Meanwhile, the US retail sales slumped more than expected in April. The DJIA index fell 2.7% to end at 23685.4, and the NASDAQ index also declined 1.2% to close at 9014.6.