DS Smith, up 3.7%, in its half yearly results announced that revenues rose to £3,362m from £2,889m recorded in the same period a year ago.

Frontier Developments, up 0.2%, announced a new expansion for the ultimate zoo simulation, Planet Zoo, which introduces five animals to the game.

Tristel, up 15.5%, today, in its AGM statement, announced that its geographical markets sales gained momentum as hospitals have gradually returned to normal service levels. Further, the company intends to publish its interim results on 21 February 2022.

Bango, up 7.7%, announced that it has partnered with South Korea’s Kakao Pay, allowing millions of users in South Korea to collect online payments and offer product bundles through the Bango Platform.

Cambridge Cognition, up 6.6%, announced that it has won a contract worth £1.0m for an additional schizophrenia clinical trial.

Marshall Motor, unchanged at 392p, announced its intention to recommend shareholders accept offer by Constellation Automotive Holdings Limited.

Aferian, unchanged at 159.5p, today, in its trading update, announced that overall, it has witnessed a strong trading performance, with its all key its financial metrics in line with Board expectations. Further, it would release its results for the year ended 30 November 2021 on 7 February 2022.

GRC International Group, down 12.7%, announced that during the period ended November 2021, it had over 5,000 active, paying subscribers to six lines of the Group's online products and services within two years.

Feedback, down 10%, today, announced that it has entered into a partnership with Amazon Web Services (AWS) to establish and deliver cloud-based TB screening services to rural communities in India.

Sareum, down 9.5%, announced an update on its AGM in response to the recent emergence of the omicron variant of the SARS-CoV-2 virus.

SDI Group, down 7.9%, in its interim results for the six months ended 31 October 2021, announced that revenues rose to £24.7m from £14.1m recorded in the same period previous year.

1Spatial, down 2%, announced that it has won a multi-year contract worth £0.6m with the Rural Payments Agency (RPA) an Executive Agency of the Department for Environment, Food and Rural Affairs (Defra), which includes £0.4m in software licences over two years.

Kier Group, down 1.9%, announced that it has been appointed to the Department for Education's (DfE's) £7b 2021 Construction Framework.

UK markets ended higher last week, as concerns over the Omicron Covid-19 variant faded. On the data front, UK’s house prices accelerated at its fastest pace in 15 years in November, while the BRC retail sales climbed in November, as consumers took advantage of Black Friday discounts on clothing. Also, the construction PMI rose to a 4-month high in November, as supply-chain disruptions subsided.

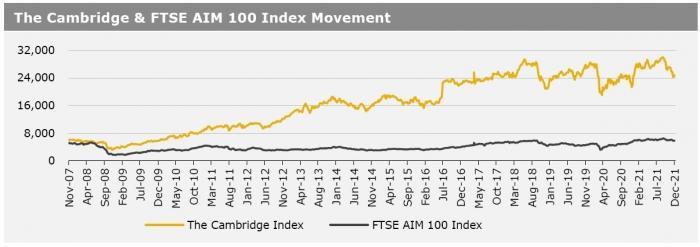

On the flipside, Britain’s economy slowed in October, denting expectations that the Bank of England would raise interest rates. Additionally, UK’s industrial production dropped in October, while manufacturing production rose less than expected in the same month. The FTSE 100 index advanced 2.4% to settle at 7291.8, while the FTSE AIM 100 index rose 0.9% to close at 5859.5. Also, the FTSE techMARK 100 index gained 1.7% to end at 6713.3.

US markets ended higher in the previous week, as investors digested the recent US inflation data. On the macro front, the US inflation accelerated at its fastest pace since 1982 in November, as consumers spent more on food and a range goods, while the consumer sentiment index rebounded in December. Additionally, the US weekly jobless claims dropped to a 52-year low in the week ended 3 December 2021, while the JOLTS job openings climbed in October. Moreover, the US trade deficit significantly narrowed in October, as exports reached an all-time high. The DJIA index rose 4.0% to end at 35971.0, while the NASDAQ index gained 3.6% to close at 15630.6.