Netcall, up 5.4%, announced that it has entered into a global framework agreement with a leading multinational financial services firm having operations in around 120 countries. Marshall Motor, up 5.1%, in its unaudited interim results for the six months ended 30 June 2021, announced that its revenues jumped to £1,334.1m from £895.3m recorded in the same period a year ago. The board has declared an interim dividend of 8.86p per share, which would be paid by 17 September 2021. Oracle Power, up 2.6%, announced that the Department of Mines, Industry Regulation and Safety - Western Australia, has approved its Programme of Work (PoW) for the Northern Zone Gold Project, located 25km east of Kalgoorlie in Western Australia. Checkit, up 1.6%, in its trading update for the six months to 31 July 2021, announced that overall group revenue increased by 13% and recurring revenue by 31% compared to the previous year. Also, it has witnessed an increase by 16% in annual recurring revenue (ARR) in the half year, driven by new subscription contracts. As at 31 July 2021, cash balance stood at £8.5m.

Gaming Realms, down 2.5%, announced that it would release its interim results for the six months ended 30 June 2021 on 13 September 2021. Aferian, down 0.3%, announced that it has appointed Investec Bank Plc as its Nomad and Sole Broker, with immediate effect. Science Group, unchanged at 445.0p, announced that Jon Brett, previously Group Financial Controller, has been appointed as acting Finance Director. Sareum, unchanged at 8.9p, announced that it has raised £1.0m through a subscription by a high net worth individual for 12,121,212 new ordinary shares of 0.025p each at a price of 8.25p per share.

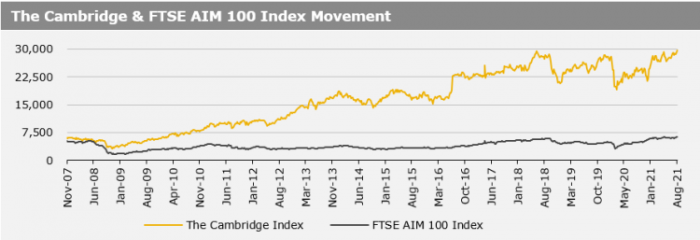

UK markets ended higher last week, as Britain’s economic growth accelerated in the 2Q 2021. Data showed that, UK’s gross domestic product (GDP) jumped in the second quarter, as Covid-19 lockdown restrictions eased, while the nation’s industrial production climbed more than expected in June. On the contrary, UK’s retail sales grew at a slower pace in July, amid decline in consumer spending, while the nation’s housing market lost momentum in July, due to the tapering in stamp duty holiday. Additionally, manufacturing production rose less-than-expected in June. The FTSE 100 index advanced 1.3% to settle at 7218.7, while the FTSE AIM 100 index rose 0.3% to close at 6259.3. Also, the FTSE techMARK 100 index gained 3.5% to end at 7477.9.

US markets ended mixed in the previous week, as weaker than expected growth in US inflation outweighed optimism surrounding the government’s $1t infrastructure aid bill. On the macro front, US consumer prices rose at a slower pace in July, easing concerns that the US Federal Reserve (Fed) would taper its economic support sooner than expected, while the nation’s business optimism index declined in July. Additionally, the US consumer sentiment dropped to its lowest level since 2011 in August, amid concerns over the country’s growth prospects. Meanwhile, the US JOLTS job openings climbed to a record high in June, while the nation’s weekly jobless claims fell for a third consecutive week in the week ended 6 August 2021, signalling recovery in the US labour market. The DJIA index rose 0.9% to end at 35515.4, whereas the NASDAQ index lost 0.1% to close at 14822.9.